Breaking into Health Care Equity Research: Top Interview Questions and Winning Answers

Are you preparing for a health care sector equity research interview and feeling the pressure to ace it? Don’t worry; you’re not alone! The health care industry, with its complex regulatory environment, rapid innovations, and unique business models, requires a specialized set of skills and deep industry knowledge. Whether it’s understanding the impact of drug pipelines, evaluating medical device companies, or analyzing health insurance providers, interviewers are looking for analysts who can grasp these complexities and translate them into investment insights. In this guide, we’ll dive into the most common health care equity research interview questions and provide answers that will help you stand out from the competition. Let’s get started and set you on the path to landing your dream role!

Explore-

Technical & Analytical Questions

Can you walk us through a discounted cash flow (DCF) analysis for a health care company?

💡Focus on understanding the candidate’s financial modeling skills and ability to apply them within the health care industry.

Suggested Answer:

Here's a brief walkthrough of a DCF analysis for a healthcare company:

Forecast Free Cash Flows (FCF): Start by projecting the company’s financials, focusing on revenue growth, operating margins, working capital needs, and capital expenditures. Healthcare companies often face regulatory challenges, so factor in R&D costs, patent expirations, and reimbursement rates.

Calculate Terminal Value: Use the perpetuity growth method or exit multiple to estimate the value beyond the forecast period, considering long-term healthcare trends like aging populations or advancements in medical technology.

Discount Cash Flows: Use the company’s weighted average cost of capital (WACC) to discount both the projected FCFs and terminal value to present value. In healthcare, beta may be influenced by regulatory risks and innovation cycles.

Sum the Present Values: Add the present value of the forecasted FCFs and terminal value to get the enterprise value. Adjust for debt, cash, and other factors to arrive at equity value.

How would you approach valuing a pharmaceutical company with a drug in late-stage clinical trials?

💡Tests the candidate’s ability to evaluate the impact of future drug launches on a company’s valuation.

Suggested Answer:

To value a pharmaceutical company with a drug in late-stage clinical trials, I'd take a probability-weighted approach:

Pipeline Analysis: Assess the drug’s market potential, including the target patient population, pricing, and expected market share. Consider competition and unmet needs in the therapeutic area.

Probability of Success: Use industry benchmarks or historical data to assign a probability of success based on the drug’s phase (e.g., 60-70% for late-stage trials).

Revenue Forecast: Project revenues if the drug is approved, factoring in patent protection, pricing, and adoption rates. Also, model potential peak sales and patent cliff risks.

DCF with Risk-Adjusted FCF: Conduct a DCF analysis, adjusting free cash flows for the probability of approval. Use a higher discount rate to reflect regulatory risks.

Scenario Analysis: Perform sensitivity analysis around approval timelines, pricing, and market adoption to understand valuation under different outcomes.

This method captures both the upside potential and inherent risks of the drug.

Explain how you would forecast revenue for a hospital or medical device company.

💡Aims to gauge understanding of industry revenue drivers, such as patient volume, reimbursement rates, or device innovation.

Suggested Answer:

To forecast revenue for a hospital or medical device company, I'd focus on key industry-specific drivers:

Hospital Revenue:

Patient Volume: Estimate based on population trends, occupancy rates, and service mix (inpatient vs. outpatient).

Reimbursement Rates: Factor in payer mix (Medicare, Medicaid, private insurance) and regulatory changes impacting reimbursement.

New Services or Capacity Expansion: Incorporate any planned expansions or new treatment offerings.

Medical Device Company Revenue:

Unit Sales Growth: Forecast based on market penetration, adoption rates of new technologies, and replacement cycles.

Pricing: Consider device innovation, competitive pricing pressures, and reimbursement coverage.

Geographic Expansion: Account for potential growth in new markets or regions.

For both, I'd adjust for macro factors like healthcare policy changes and technological advancements.

How do regulatory changes (e.g., FDA approvals or CMS reimbursement policies) impact health care company valuations?

💡Checks the candidate’s knowledge of the regulatory landscape in the health care sector.

Suggested Answer:

Regulatory changes can significantly impact healthcare company valuations in a few key ways:

FDA Approvals: A new drug or device approval can lead to revenue growth by expanding market opportunities, while delays or rejections can hurt projected cash flows and increase risk.

CMS Reimbursement Policies: Favorable changes in reimbursement rates (e.g., Medicare or Medicaid) can boost revenue by increasing patient access, while cuts in reimbursement can shrink margins.

Compliance Costs: Stricter regulations can increase operational costs, affecting profitability.

Overall, regulatory shifts directly influence revenue forecasts, risk factors, and ultimately valuation through cash flow and discount rates.

What are the key metrics you would focus on when analyzing a biotechnology company?

💡Aimed at identifying important financial and non-financial metrics like clinical trial milestones, R&D expenses, and market potential.

Suggested Answer:

When analyzing a biotechnology company, I would focus on these key metrics:

Clinical Trial Milestones: Track progress through phases, especially late-stage trials, as they directly affect valuation and market potential.

R&D Expenses: Evaluate the level of investment in research and development, as it's critical for drug pipeline growth.

Cash Burn Rate: Assess how quickly the company is using its cash reserves, especially for companies pre-revenue.

Partnerships and Licensing Deals: Consider collaborations or licensing agreements that can provide funding or market access.

Market Potential: Estimate the size of the addressable market for the company’s drugs, factoring in competition and pricing.

Describe how you would evaluate the financial health of a health care services company.

💡Explores the candidate’s ability to analyze cash flow, debt levels, margins, and operational efficiency.

Suggested Answer:

To evaluate the financial health of a healthcare services company, I’d focus on:

Cash Flow: Look at operating cash flow to ensure the company is generating sufficient cash from its core services. Free cash flow is key for sustainability and growth.

Debt Levels: Assess the debt-to-equity ratio and interest coverage to gauge the company’s leverage and its ability to service debt.

Profit Margins: Review operating and EBITDA margins to understand profitability and how efficiently the company is managing costs.

Operational Efficiency: Analyze metrics like revenue per bed (for hospitals) or revenue per physician to evaluate resource utilization and efficiency.

How do you model the lifecycle of a drug from research and development to commercialization in your financial models?

💡Tests the candidate’s ability to integrate drug pipeline timelines into revenue forecasting.

Suggested Answer:

To model the lifecycle of a drug from R&D to commercialization, I follow these steps:

R&D Phase: Estimate costs and timelines for each phase (preclinical, Phase 1-3 trials). Assign a probability of success based on industry benchmarks for each stage.

Regulatory Approval: Factor in the timeline for FDA or other regulatory approvals, with associated costs and risks of delay or rejection.

Commercialization: Once approved, forecast revenue based on market size, expected adoption rates, pricing, and competition. Include sales ramp-up and peak sales estimates.

Patent Expiry: Model the revenue decline after patent expiration, factoring in generic competition.

This approach ties each lifecycle phase to financial impacts, adjusting for risks and timelines at each step.

What role does M&A activity play in the health care sector, and how would you analyze its impact on a company’s stock price?

💡Evaluates the candidate’s understanding of health care consolidation trends and their effects on shareholder value.

Suggested Answer:

M&A activity plays a crucial role in the healthcare sector by driving consolidation, enhancing competitive positioning, and enabling companies to achieve synergies. Here’s how I would analyze its impact on a company’s stock price:

Strategic Fit: Assess whether the acquisition aligns with the company’s long-term strategy, such as expanding product offerings, entering new markets, or gaining access to innovative technologies.

Financial Metrics: Evaluate the transaction's financial implications, including the price paid, expected cost synergies, and how it will affect earnings per share (EPS) and cash flow.

Market Reaction: Monitor immediate market reactions, as stock prices often respond positively to perceived strategic benefits or negatively to concerns about overpaying or integration challenges.

Long-Term Value Creation: Analyze post-merger performance against pre-merger projections, focusing on revenue growth, margin improvement, and integration success to determine if the acquisition created shareholder value.

This comprehensive approach helps understand the M&A's potential to enhance or detract from a company’s stock performance.

Explain how you would perform a comparative analysis of two health care companies in the same sub-sector.

💡Aims to see how the candidate compares companies using key financial metrics, market share, and growth potential.

Suggested Answer:

To perform a comparative analysis of two healthcare companies in the same sub-sector, I would follow these steps:

Select Key Financial Metrics: Focus on relevant metrics such as revenue growth, operating margins, EBITDA, and return on equity (ROE) to gauge profitability and efficiency.

Valuation Ratios: Compare valuation metrics like Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Enterprise Value-to-EBITDA (EV/EBITDA) to assess market valuation relative to financial performance.

Market Share and Positioning: Analyze each company's market share within the sub-sector, looking at their competitive strengths, product offerings, and geographic presence.

Growth Potential: Evaluate growth drivers such as R&D pipeline, upcoming product launches, and expansion into new markets or segments.

Risks and Opportunities: Consider regulatory risks, patent expirations, and competitive threats, along with opportunities for innovation or partnership.

By synthesizing these factors, I can draw insights about each company’s relative strengths and weaknesses, providing a clearer picture of their market positioning and growth potential.

Can you discuss the significance of patent cliffs for pharmaceutical companies, and how do they affect valuation?

💡Examines knowledge of patent expirations and their impact on revenue streams and competitive positioning.

Suggested Answer:

Patent cliffs are critical for pharmaceutical companies as they represent the expiration of patent protection on key drugs, leading to increased competition from generic alternatives. Here’s how they affect valuation:

Revenue Loss: Once a patent expires, a company can lose a significant portion of its revenue as generics enter the market, often leading to rapid price declines.

Cash Flow Impact: The loss of exclusive sales rights can significantly reduce cash flow, affecting the company's ability to invest in R&D or pay dividends.

Valuation Adjustments: Analysts often adjust their revenue forecasts and valuation models to account for the anticipated decline in sales post-expiration, using lower projections for affected drugs.

Pipeline Importance: Companies with a strong R&D pipeline can mitigate the impact of patent cliffs by having new products ready for launch, which can sustain or grow revenue.

Overall, patent cliffs highlight the importance of innovation and strategic planning in maintaining competitive positioning and financial health in the pharmaceutical sector.

Industry Understanding

What are the biggest trends currently affecting the health care industry, and how do they influence equity research in this sector?

💡Evaluates the candidate’s industry knowledge, including topics like telemedicine, personalized medicine, or health care reform.

Suggested Answer:

Currently, several significant trends are affecting the healthcare industry:

Telemedicine: The rapid adoption of telehealth services is expanding access to care, reducing costs, and changing patient-provider interactions. This trend influences equity research by highlighting companies that are well-positioned to capitalize on technology.

Personalized Medicine: Advances in genomics and biotechnology are enabling tailored treatments, which can improve patient outcomes. Equity research needs to focus on companies with strong R&D pipelines in this area to identify future growth opportunities.

Healthcare Reform: Ongoing changes in healthcare policies, including reimbursement models and regulatory shifts, impact revenue models for providers and payers. Analysts must stay informed on these developments to assess risks and opportunities for their coverage.

Aging Population: An increasing elderly population drives demand for healthcare services and products, influencing investment strategies and valuations of companies in this space.

These trends shape equity research by affecting market dynamics, competitive positioning, and the financial outlook of healthcare companies, requiring analysts to adapt their models and forecasts accordingly.

How does the pricing power of pharmaceutical companies differ from that of generic drug manufacturers?

💡Aims to understand the candidate’s grasp of pricing dynamics and competitive pressures in the pharmaceutical space.

Suggested Answer:

The pricing power of pharmaceutical companies significantly differs from that of generic drug manufacturers due to several factors:

Patent Protection: Brand-name pharmaceutical companies often have exclusive rights to their patented drugs, allowing them to set higher prices without competition. This pricing power is based on the uniqueness and innovation of their products.

Market Demand: Pharmaceutical companies can leverage strong brand recognition and established relationships with healthcare providers to maintain higher prices, especially for specialty drugs.

Competition and Market Entry: Generic drug manufacturers operate in a highly competitive environment with lower profit margins. Once a patent expires, multiple generics can enter the market, leading to price erosion as they compete for market share.

Regulatory Environment: While pharmaceutical companies must navigate regulatory hurdles to maintain pricing, generic manufacturers are often restricted to pricing strategies that align with market dynamics and are influenced by payer negotiations.

In summary, pharmaceutical companies generally have more pricing power due to exclusivity and brand strength, while generic manufacturers face significant competitive pressures that limit their ability to raise prices.

What are the most important regulatory agencies and policies that affect health care companies?

💡Tests understanding of FDA, EMA, CMS, and their roles in shaping the industry.

Suggested Answer:

The most important regulatory agencies and policies affecting healthcare companies include:

FDA (Food and Drug Administration): In the U.S., the FDA regulates the approval and monitoring of pharmaceuticals, medical devices, and biologics. Their guidelines shape product development, clinical trials, and marketing practices.

EMA (European Medicines Agency): Similar to the FDA, the EMA oversees the evaluation and supervision of medicines in Europe. Its approval processes and guidelines are crucial for companies looking to market their products in the European Union.

CMS (Centers for Medicare & Medicaid Services): CMS governs Medicare and Medicaid reimbursement policies in the U.S. Changes in CMS regulations impact how healthcare providers are compensated and influence the pricing strategies of pharmaceutical and medical device companies.

State Regulatory Agencies: Each state has its own regulatory bodies that enforce healthcare laws, which can affect the operation and licensing of healthcare providers and facilities.

These agencies and their associated policies are essential as they directly impact product development timelines, market access, reimbursement rates, and overall compliance in the healthcare industry. Understanding their roles is critical for effective equity research.

How would you assess the potential risks and opportunities in a health care company's pipeline of experimental drugs?

💡Evaluates the candidate’s ability to assess research risk, clinical trial data, and market potential.

Suggested Answer:

To assess the potential risks and opportunities in a healthcare company's pipeline of experimental drugs, I would follow these steps:

Clinical Trial Data: Analyze the design, results, and endpoints of ongoing and completed trials. Strong efficacy and safety data can indicate a lower risk of regulatory rejection and market success.

Probability of Success: Use industry benchmarks to estimate the likelihood of advancing through each clinical phase, considering factors like trial size and historical success rates for similar drugs.

Market Potential: Evaluate the size of the addressable market, competitive landscape, and unmet medical needs. Products addressing significant health issues or offering unique benefits often present greater opportunities.

Regulatory Landscape: Consider potential regulatory hurdles and approval timelines. Understanding the FDA or EMA's stance on similar drugs can help gauge the likelihood of approval.

Financial Implications: Assess the company’s resources for R&D, including cash burn rates and funding sources. A well-capitalized company may better withstand setbacks in its pipeline.

What impact does the Affordable Care Act have on the financial performance of hospitals and insurers?

💡Focuses on understanding health care reform and its implications for different industry segments.

Suggested Answer:

The Affordable Care Act (ACA) has several significant impacts on the financial performance of hospitals and insurers:

Increased Patient Volume: The ACA expanded insurance coverage to millions of Americans, leading to higher patient volumes for hospitals. This can improve revenue through increased admissions and outpatient services.

Reimbursement Changes: The ACA shifted reimbursement models from fee-for-service to value-based care, incentivizing hospitals to focus on quality and efficiency. This can lead to cost savings but also requires investments in care coordination.

Medicaid Expansion: States that opted to expand Medicaid under the ACA saw a reduction in uninsured patients, improving hospitals' financial stability and reducing uncompensated care costs.

Insurance Market Reforms: Insurers are required to cover essential health benefits and cannot deny coverage based on pre-existing conditions. While this expands the market, it can also increase claims and impact profit margins.

Explain how you stay updated with the latest medical and scientific developments relevant to your coverage.

💡Aims to assess the candidate’s research and information-gathering skills in this fast-evolving sector.

Suggested Answer:

To stay updated with the latest medical and scientific developments relevant to my coverage, I use a multifaceted approach:

Industry Journals and Publications: I regularly read leading medical journals like The New England Journal of Medicine and The Lancet to stay informed about groundbreaking research and clinical trial results.

Conferences and Webinars: I attend relevant conferences and webinars, such as those held by the American Medical Association or specialized medical societies, to gain insights directly from experts and network with industry professionals.

News Aggregators and Alerts: I set up alerts on platforms like Google Scholar and PubMed for key topics and companies in my coverage, ensuring I receive timely updates on new studies or approvals.

Networking: I maintain relationships with industry experts, analysts, and key opinion leaders to exchange information and insights about emerging trends and innovations.

Company Reports and Filings: I closely monitor earnings calls, investor presentations, and SEC filings from companies in my coverage to understand their strategic initiatives and R&D focus.

Can you discuss the differences between health care services and life sciences tools and diagnostics from an equity research perspective?

💡Evaluates sector-specific nuances in valuation, growth drivers, and risk profiles.

Suggested Answer:

From an equity research perspective, the differences between healthcare services and life sciences tools and diagnostics can be summarized as follows:

Healthcare Services: Valuation often focuses on revenue multiples, EBITDA margins, and cash flow generation due to the service-oriented nature of the business. Growth rates are influenced by patient volume and reimbursement rates.

Life Sciences Tools and Diagnostics: Valuations may rely more on product adoption rates, R&D pipeline potential, and market share in a competitive landscape. Metrics like Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios are commonly used.

Growth Drivers:

Healthcare Services: Growth is typically driven by factors such as demographic trends (aging population), healthcare reforms, and increasing demand for care. Expansion into new service lines or geographic regions can also fuel growth.

Life Sciences Tools and Diagnostics: Growth is heavily influenced by technological advancements, innovation in diagnostic tests, and demand for personalized medicine. Partnerships with pharmaceutical companies for research also play a key role.

Risk Profiles:

Healthcare Services: Risks include regulatory changes, reimbursement pressures, and operational efficiencies. Additionally, reputational risks can impact patient volumes.

Life Sciences Tools and Diagnostics: Risks are more related to R&D failures, regulatory approval processes, and competition from new technologies or entrants. The success of product launches can also significantly impact financial performance.

Understanding these nuances is essential for accurate analysis and investment recommendations within these distinct sectors.

How does the growth of personalized medicine impact the future of health care equity research?

💡Tests the candidate’s ability to foresee future shifts in the industry and their implications for investment.

Suggested Answer:

The growth of personalized medicine is poised to significantly impact the future of healthcare equity research in several ways:

Shift in Valuation Models: As personalized medicine focuses on tailored treatments based on genetic and molecular profiles, equity research will need to adjust valuation models to account for potential higher pricing and market demand for these specialized therapies.

Increased R&D Investment: Companies investing in personalized medicine may see enhanced growth prospects, prompting analysts to pay closer attention to R&D pipelines and clinical trial outcomes as indicators of future success.

Regulatory Landscape Changes: Personalized medicine may lead to evolving regulatory requirements, necessitating a deeper understanding of approval processes and market access strategies for new therapies. Equity research will need to incorporate these factors into risk assessments.

Focus on Outcomes-Based Metrics: As the effectiveness of treatments becomes a priority, analysts will need to emphasize outcomes-based metrics, such as real-world evidence and long-term patient benefits, in their evaluations.

Emerging Partnerships: The rise of personalized medicine often leads to collaborations between biotech firms, pharmaceutical companies, and technology providers. Equity research will need to identify and analyze these partnerships as indicators of market potential and competitive advantage.

What challenges do you see for pharmaceutical companies in bringing a new drug to market, and how do these challenges affect investment decisions?

💡Examines an understanding of drug development hurdles, including clinical trials, regulatory approval, and market competition.

Suggested Answer:

Bringing a new drug to market presents several significant challenges for pharmaceutical companies, which in turn affect investment decisions:

Clinical Trial Risks: The process of conducting clinical trials is lengthy and costly, with a high rate of failure. Investors must consider the probability of success at each trial stage, as setbacks can significantly delay timelines and increase expenses.

Regulatory Approval: Navigating the regulatory landscape, particularly with agencies like the FDA or EMA, can be complex. Delays or unexpected requirements can impact the timing of market entry, making it crucial for investors to evaluate a company's regulatory strategy and track record.

Market Competition: Once approved, new drugs face competition from existing treatments and generics. Investors need to assess the market potential and differentiation of the new drug, including its pricing strategy and reimbursement landscape.

Reimbursement Challenges: Securing favorable reimbursement from insurers and government programs is vital for commercial success. If a drug is not adequately reimbursed, its market potential can be severely limited, influencing investment attractiveness.

Public Perception and Litigation: Negative public perception or legal challenges related to side effects or pricing can also impact a drug's market performance. Investors should consider a company’s risk management strategies and how they address these issues.

How would you assess the impact of demographic trends like aging populations on health care equities?

💡Explores knowledge of macro-level trends affecting long-term investment in health care companies.

Suggested Answer:

To assess the impact of demographic trends, particularly aging populations, on healthcare equities, I would consider the following factors:

Increased Demand for Healthcare Services: Aging populations typically lead to higher demand for healthcare services, including hospital admissions, outpatient care, and long-term care. This trend can drive revenue growth for healthcare providers and services.

Chronic Disease Management: Older populations often experience higher rates of chronic diseases, which increases the need for ongoing treatments and medications. Companies focused on chronic disease management or specialized therapies may see substantial growth opportunities.

Investment in Elderly Care: There is likely to be a surge in investment in sectors like home healthcare, assisted living facilities, and geriatric care services, as families and governments seek to provide quality care for aging individuals.

Innovations in Technology: The demand for health technologies, such as telemedicine and remote monitoring devices, will likely grow as older adults seek convenient and efficient healthcare solutions. This opens new avenues for investment in health tech companies.

Policy and Reimbursement Implications: Government policies and reimbursement frameworks will need to adapt to the changing demographic landscape. Analysts should evaluate how potential reforms may impact funding for healthcare services.

Financial Analysis and Valuation

What is your process for conducting a thorough fundamental analysis of a health care stock?

💡Gauges the candidate’s general approach to financial analysis, focusing on key drivers like revenue, margins, and growth prospects.

Suggested Answer:

My process for conducting a thorough fundamental analysis of a healthcare stock involves several key steps:

Understanding the Business Model: I start by analyzing the company's business model, including its revenue streams, target markets, and competitive positioning within the healthcare sector.

Financial Statement Analysis: I review the company's financial statements—income statement, balance sheet, and cash flow statement—to assess key metrics like revenue growth, profit margins, and cash flow generation. I pay special attention to trends over time and compare them with industry peers.

Revenue Drivers: I identify and evaluate the key drivers of revenue, such as patient volume, reimbursement rates, product pipelines, or service offerings, depending on whether it’s a healthcare provider, pharmaceutical company, or medical device manufacturer.

Cost Structure and Profitability: I analyze the cost structure to understand fixed versus variable costs and assess the company's operating margins. This helps gauge operational efficiency and potential for scalability.

Growth Prospects: I investigate growth opportunities, including new product launches, expansion into new markets, or strategic partnerships. I also consider industry trends, demographic changes, and technological advancements that may influence future growth.

Risk Assessment: I conduct a risk analysis, considering regulatory changes, competitive pressures, and macroeconomic factors that could impact the company's performance. Understanding these risks is crucial for making informed investment decisions.

Valuation: Finally, I apply valuation methodologies such as discounted cash flow (DCF) analysis and comparable company analysis to estimate the stock's intrinsic value and assess whether it is undervalued or overvalued relative to its peers.

How do you account for research and development (R&D) expenses in your valuation models for pharmaceutical companies?

💡Evaluates how the candidate factors long-term investment in R&D into the company’s valuation.

Suggested Answer:

In my valuation models for pharmaceutical companies, I account for research and development (R&D) expenses through the following steps:

Capitalization of R&D Expenses: I consider capitalizing R&D expenses, treating them as investments rather than immediate costs. This approach reflects the potential future benefits these expenses may generate, particularly for successful drug launches.

Forecasting R&D Spend: I project future R&D expenses based on the company’s historical spending patterns, pipeline stages, and strategic goals. Understanding how much the company invests in R&D helps gauge its commitment to innovation.

Probability-Weighted Outcomes: I apply probability-weighted scenarios to account for the uncertainty of drug development. Each drug in the pipeline is assessed for its likelihood of success based on clinical trial stages, and the expected revenue from successful drugs is discounted accordingly.

Impact on Cash Flow: I incorporate R&D expenses into cash flow projections, ensuring that my forecasts reflect the timing and magnitude of these investments. This affects the free cash flow calculations, which are crucial for discounted cash flow (DCF) analysis.

Risk Assessment: I assess the risk associated with R&D expenditures by considering factors such as the competitive landscape, regulatory hurdles, and potential market demand for new therapies. Higher risks may lead to higher discount rates in my valuation models.

What role do clinical trial outcomes play in stock price movements, and how do you factor this into your analysis?

💡Focuses on the importance of non-financial events like trial results in assessing the value of health care stocks.

Suggested Answer:

Clinical trial outcomes have a significant impact on stock price movements, especially for pharmaceutical and biotechnology companies. Positive results can lead to a sharp increase in stock prices as they indicate potential future revenue from a new drug, while negative or inconclusive results can cause a sharp decline.

In my analysis, I factor this by:

Probability-Weighted Scenarios: I model different outcomes based on trial phases (e.g., Phase I, II, III) and assign probabilities of success. Each outcome is tied to projected future revenues or losses.

Timeline Analysis: I track key milestones and timelines for trial results. Stock prices often react leading up to these announcements, so I account for potential volatility.

Market Potential: I assess the potential market size of the drug being tested and incorporate it into my valuation models. A successful drug with a large addressable market can lead to substantial price movements.

By integrating clinical trial outcomes into both the valuation model and risk analysis, I provide a more comprehensive view of the stock’s potential movement based on these non-financial events.

Can you explain how free cash flow is particularly relevant when analyzing health care equipment manufacturers?

💡Tests knowledge of capital-intensive sectors and how cash flow plays a role in evaluating investment prospects.

Suggested Answer:

Free cash flow (FCF) is especially relevant when analyzing healthcare equipment manufacturers because these companies often operate in capital-intensive environments. Here’s how I incorporate FCF in my analysis:

Capital Expenditure: Healthcare equipment manufacturers require significant ongoing investment in R&D and production facilities. FCF helps evaluate how much cash the company generates after covering these necessary capital expenditures, indicating financial flexibility.

Cash Flow Generation: FCF is a key indicator of the company’s ability to fund growth initiatives, such as new product development or acquisitions, without relying too heavily on external financing.

Valuation Metric: I use FCF in discounted cash flow (DCF) models to assess the company’s intrinsic value. Consistent FCF generation is a strong sign of financial health and shareholder value creation.

Risk Assessment: For capital-intensive companies, high FCF mitigates risks, especially during economic downturns, as it allows the company to maintain operations and invest in innovation.

By focusing on FCF, I can better assess the long-term sustainability and growth potential of healthcare equipment manufacturers.

What financial ratios do you consider most important for analyzing a hospital chain, and why?

💡Focuses on understanding specific financial metrics relevant to health care services, like occupancy rates and operating margins.

Suggested Answer:

When analyzing a hospital chain, the most important financial ratios I consider are:

Occupancy Rate: This measures the utilization of hospital capacity. A higher occupancy rate indicates efficient use of resources and directly impacts revenue generation.

Operating Margin: This shows the hospital's profitability from core operations. It reflects how well the hospital manages its costs relative to revenue, which is crucial in a low-margin industry like healthcare services.

Debt-to-Equity Ratio: Hospitals often rely on debt for expansion or facility upgrades. This ratio helps assess the hospital's financial leverage and its ability to manage debt sustainably.

EBITDA Margin: This is key for understanding cash flow generation from core operations before non-cash expenses. A strong EBITDA margin suggests operational efficiency and the ability to invest in future growth.

These ratios provide a clear picture of financial health, operational efficiency, and the hospital's ability to generate sustainable revenue.

How would you assess the financial impact of a company’s decision to pursue a vertical integration strategy?

💡Evaluates the candidate’s understanding of how strategic initiatives affect the financials and growth outlook of health care companies.

Suggested Answer:

To assess the financial impact of a company’s decision to pursue vertical integration, I would focus on the following key factors:

Cost Synergies: Vertical integration often reduces costs by eliminating middlemen. I would analyze how this impacts gross margins and operating expenses, improving overall profitability.

Revenue Growth: I’d evaluate whether controlling more of the supply chain leads to better pricing power, product differentiation, or enhanced service offerings, potentially driving higher revenue growth.

Capital Expenditure: Vertical integration often requires significant upfront investment in facilities, technology, or acquisitions. I would assess the impact on free cash flow and the company’s ability to fund these expenditures sustainably.

Risk Diversification: By owning more stages of production or distribution, the company may mitigate supply chain risks. I’d examine how this reduces external dependencies and enhances operational stability.

By analyzing these factors, I can estimate the long-term impact on profitability, growth, and risk profile, helping determine whether the strategy adds value.

How would you analyze the financial statements of a health insurance company?

💡Tests knowledge of revenue drivers, expense management, and key financial metrics like medical loss ratio (MLR).

Suggested Answer:

When analyzing the financial statements of a health insurance company, I focus on the following key areas:

Revenue Drivers: I examine premium income, which is the main revenue source, along with investment income. Understanding changes in policyholder numbers and premium pricing helps assess revenue growth.

Medical Loss Ratio (MLR): This is a critical metric that compares the cost of claims paid to the premiums earned. A lower MLR indicates better profitability, as more premiums are retained relative to claims paid.

Expense Management: I analyze administrative expense ratios, which reflect operational efficiency. Managing these costs is essential to improving operating margins.

Reserves and Liabilities: I review claim reserves and the company’s ability to cover future claims, which speaks to its financial stability.

By focusing on these factors, I get a comprehensive view of profitability, efficiency, and risk management in the health insurance business.

How do you approach forecasting revenue for a health care technology company that operates a SaaS model?

💡Aims to understand the candidate’s ability to work with different business models and forecasting techniques.

Suggested Answer:

To forecast revenue for a healthcare technology company operating a SaaS model, I would focus on the following steps:

Customer Base Growth: Estimate the growth in the number of customers or subscriptions, factoring in both new customer acquisition and retention rates.

Average Revenue per User (ARPU): Analyze how much each customer is contributing on average. This can be influenced by pricing models, upselling, or tiered service offerings.

Churn Rate: Consider customer churn, as the subscription model relies on recurring revenue. A lower churn rate will positively impact long-term revenue.

Contract Length and Renewal Rates: For SaaS models, understanding contract durations and renewal likelihood helps forecast future revenue more accurately.

Market Expansion and Product Development: Factor in growth drivers like expanding into new markets or launching additional services.

By combining these metrics, I can create a robust forecast that captures both current performance and future potential for growth.

What valuation method do you find most effective for health care stocks: DCF, relative valuation, or precedent transactions, and why?

💡Explores the candidate’s preference for valuation methods based on the nuances of health care.

Suggested Answer:

I find Discounted Cash Flow (DCF) to be the most effective valuation method for healthcare stocks, especially for companies with predictable cash flows, like established pharmaceutical firms. DCF allows me to capture the long-term value of a company’s future cash flows, which is crucial for health care companies with significant R&D investments and drug pipelines.

However, I also use relative valuation when comparing companies in the same sub-sector, as it helps gauge how the market is pricing similar companies, and precedent transactions are useful for M&A-driven companies.

The choice depends on the specific situation, but DCF gives me a solid foundation, especially when future cash flow visibility is key.

Can you explain the importance of cash flow versus earnings in evaluating a biotech startup?

💡Evaluates how the candidate prioritizes key financial metrics in a sector known for long-term R&D investments.

Suggested Answer:

In evaluating a biotech startup, cash flow is more important than earnings because these companies typically have significant R&D expenses and may not be profitable for years. Cash flow shows the company’s ability to sustain its operations and fund its research without running out of money.

Earnings, on the other hand, can be less relevant in the early stages, as biotech startups often reinvest heavily in development. Investors in this space focus on whether the company has enough liquidity to bring its pipeline products to key milestones, making cash flow the critical metric.

Technical Interview Questions on Health Care Equity Research

How would you calculate the Net Present Value (NPV) of a biotechnology company with multiple drug candidates?

💡Walk me through the steps of estimating cash flows based on drug approval timelines, R&D costs, sales projections, and discount rates.

Suggested Answer:

To calculate the Net Present Value (NPV) of a biotechnology company with multiple drug candidates, I would follow these steps:

Estimate future cash flows: For each drug candidate, I would forecast potential cash flows based on the likelihood of approval, projected sales, market size, and pricing. This includes factoring in different stages of clinical trials.

Consider R&D costs: I’d account for ongoing R&D expenses tied to each drug, including clinical trial costs and the timeline for development.

Apply probabilities: For each drug, I would assign probabilities of success at each stage (e.g., Phase I, II, III), adjusting expected cash flows based on these probabilities.

Determine the discount rate: I’d use a discount rate that reflects the company’s cost of capital, accounting for the high risk of drug development in biotech.

Sum the discounted cash flows: For each drug, I’d calculate the present value of future cash flows, then sum these values to get the total NPV of the company.

This approach captures the uncertainty and long timelines typical in biotech.

Suppose a pharmaceutical company has 3 potential blockbuster drugs in its pipeline. How would you forecast their potential revenue over the next 10 years, considering varying success probabilities for each drug?

💡Use success probabilities at different phases (Phase II, Phase III, FDA approval) to calculate potential revenue.

Suggested Answer:

To forecast potential revenue for the three blockbuster drugs over the next 10 years, I would approach it as follows:

Estimate peak sales: For each drug, I’d estimate the potential market size and peak sales based on the drug’s target indication, pricing, and competition.

Assign success probabilities: For each drug, I’d apply probabilities of success for Phase II, Phase III, and FDA approval. These would reflect historical success rates at each phase of drug development.

Create scenario models: I would build best-case, base-case, and worst-case scenarios for each drug, adjusting expected revenues based on success probabilities at each phase.

Revenue ramp-up: I’d factor in the typical revenue ramp-up period after approval, accounting for market penetration and adoption rates, then forecast revenues annually for the next 10 years.

Discount future revenues: I’d discount future revenues to reflect the time value of money and development risks, providing a clear picture of expected returns.

This structured approach captures both the uncertainty and potential upside of the pipeline.

If a health care services company’s patient volume grows by 5% annually, and the initial volume is 1 million patients per year, what will be the total patient volume over the next five years?

💡Calculate the cumulative patient volume over the given period using the growth rate.

Suggested Answer:

To calculate the total patient volume over the next five years with an annual growth rate of 5%, I would use the formula for compound growth:

Where:

Initial Volume = 1,000,000 patients

Growth Rate = 5% (or 0.05)

n = number of years (5 years)

First, I will calculate the patient volume for each year:

Now, to find the total patient volume over the five years, I will sum up the volumes:

So, the total patient volume over the next five years would be approximately 5.8 million patients.

A pharmaceutical company has a Debt-to-Equity ratio of 1.2, total equity of $3 billion, and EBITDA of $800 million. If the interest expense is $200 million, what is the company’s Interest Coverage Ratio?

💡Calculate the Interest Coverage Ratio based on the provided data.

Suggested Answer:

To calculate the Interest Coverage Ratio (ICR), we use the formula:

From the information provided:

EBITDA = $800 million

Interest Expense = $200 million

Now, plug in the values:

This means the company’s Interest Coverage Ratio is 4.0. This indicates that the company earns four times its interest expenses, which is a strong position for meeting its debt obligations.

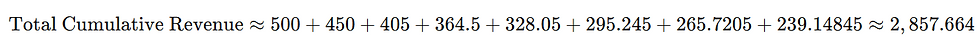

You are given the following data for a drug: an initial sales projection of $500 million in the first year, with a 10% decline in sales every year for the next 8 years. How would you calculate the total cumulative revenue?

💡Use a declining revenue rate to estimate total cumulative sales.

Suggested Answer:

To calculate the total cumulative revenue for the drug with an initial sales projection of $500 million and a 10% decline each year for the next 8 years, we can follow these steps:

Initial Sales Projection: $500 million in Year 1.

Decline Rate: 10% each subsequent year.

We can calculate the sales for each year as follows:

Now, let's sum up the revenue for all 8 years:

Calculating this gives:

Therefore, the total cumulative revenue over the 8 years would be approximately $2.86 billion.

If a health care provider’s breakeven point is $100 per patient, and the average revenue per patient is $150, what is the company’s margin per patient? How would this margin change if the average revenue drops to $90 per patient?

💡Calculate the margin at both price points.

Suggested Answer:

To calculate the margin per patient for the health care provider, we can use the following formula:

At $150 Average Revenue per Patient:

Breakeven Point: $100

Average Revenue: $150

So, the margin per patient at $150 average revenue is $50.

If Average Revenue Drops to $90 per Patient:

Breakeven Point: $100

Average Revenue: $90

In this case, the margin becomes negative, indicating a loss of $10 per patient.

Summary:

Margin at $150 Revenue: $50

Margin at $90 Revenue: -$10 (indicating a loss)

This analysis highlights the importance of maintaining revenue above the breakeven point to ensure profitability.

Calculate the EV/EBITDA multiple for a pharmaceutical company with an Enterprise Value (EV) of $20 billion and an EBITDA of $3 billion. How does this multiple compare to the industry average of 10x?

💡Compute the EV/EBITDA multiple and discuss its significance.

Suggested Answer:

To calculate the EV/EBITDA multiple, we use the formula:

Given the data:

Enterprise Value (EV): $20 billion

EBITDA: $3 billion

Plugging in the values:

Interpretation:

Calculated EV/EBITDA Multiple: 6.67x

Comparison with Industry Average:

Industry Average: 10x

Analysis:

The company's EV/EBITDA multiple of 6.67x is below the industry average of 10x. This could suggest that the company is undervalued compared to its peers, potentially indicating a buying opportunity. However, it’s essential to analyze the reasons behind this discrepancy. Factors such as market position, growth prospects, and risk profile could explain why the multiple is lower, and these should be considered when making investment decisions.

A biotechnology company’s stock is trading at $70 per share with a P/E ratio of 15x. If net income is expected to grow by 7% annually, what should the stock price be in one year, assuming the P/E ratio remains constant?

💡Use the growth rate to estimate the future stock price.

Suggested Answer:

To estimate the future stock price of the biotechnology company, we can follow these steps:

Calculate the expected net income per share:

Current stock price: $70

P/E ratio: 15x

Current net income per share = Stock Price / P/E Ratio

Calculate the expected net income for the next year:

Expected growth rate: 7%

Future net income per share = Current Net Income per Share × (1 + Growth Rate)

Calculate the future stock price:

Assuming the P/E ratio remains constant at 15x, the future stock price = Future Net Income per Share × P/E Ratio

Conclusion:

The estimated stock price in one year, assuming the P/E ratio remains constant, would be $75 per share. This represents a potential increase from the current price of $70, reflecting the company's expected growth in net income. Trailing P/E vs. Forward P/E: Key Differences- Formula + Excel File

You are given the revenue and cost structure for two hospitals. Hospital A generates $300 million annually at a cost of $200 million, while Hospital B generates $150 million at a cost of $100 million. Which hospital is more profitable and by how much?

💡Compare the profitability of both hospitals based on their revenue and cost structures.

Suggested Answer:

To determine which hospital is more profitable, we need to calculate the profit for both Hospital A and Hospital B using the formula:

Hospital A:

Revenue: $300 million

Cost: $200 million

Profit:

Hospital B:

Revenue: $150 million

Cost: $100 million

Profit:

Comparison:

Profit of Hospital A: $100 million

Profit of Hospital B: $50 million

Conclusion:

Hospital A is more profitable than Hospital B. Specifically, Hospital A is more profitable by $50 million ($100 million - $50 million). This indicates that Hospital A has a stronger financial performance relative to its cost structure.

A biotech company plans to invest $500 million in a new drug development project expected to generate $2 billion over its lifetime. If the operating costs are $800 million, what is the expected return on investment (ROI)?

💡Calculate the ROI based on the projected figures.

Suggested Answer:

To calculate the expected Return on Investment (ROI) for the biotech company, we can use the formula:

Step 1: Calculate Net Profit

Total Revenue from the project: $2 billion

Operating Costs: $800 million

Investment: $500 million

Net Profit can be calculated as follows:

Substituting the values:

Step 2: Calculate ROI

Now, substituting the Net Profit into the ROI formula:

Conclusion

The expected Return on Investment (ROI) for the biotech company's drug development project is 140%. This indicates a strong return relative to the initial investment.

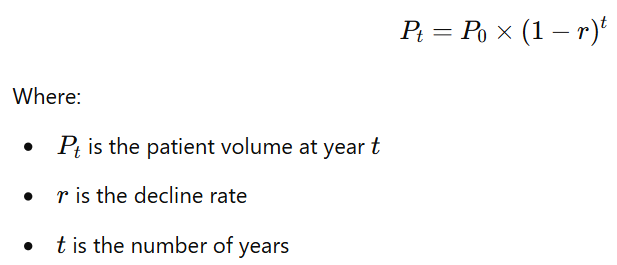

Given a health care provider with declining patient volume, how would you calculate the remaining revenue potential after five years?

💡Use an exponential decline model to estimate the remaining revenue potential.

Suggested Answer:

To calculate the remaining revenue potential for a healthcare provider facing declining patient volume over five years, we can use an exponential decline model. Here’s a step-by-step approach:

Step 1: Define Initial Variables

Initial Patient Volume: Let’s assume the initial volume is P0P_0P0 (e.g., 1 million patients).

Annual Decline Rate: Assume a decline rate of rrr (e.g., 10% or 0.10).

Revenue per Patient: Let’s say the average revenue per patient is RRR (e.g., $150).

Step 2: Calculate the Patient Volume Each Year

Using the formula for exponential decay:

Step 3: Calculate the Remaining Revenue Potential

To find the total revenue over five years, we calculate the patient volume for each year and multiply it by the revenue per patient:

Example Calculation

Assuming:

Initial Patient Volume: 1 million

Decline Rate: 10% (0.10)

Revenue per Patient: $150

Step 4: Sum the Revenue Over Five Years

Now, we sum the revenues from each year:

Conclusion

The remaining revenue potential after five years, given a declining patient volume and the specified parameters, would be approximately $552.84 million. This approach allows us to understand the long-term revenue impact of declining patient volumes effectively.

If a medical device company has a 6% annual depletion rate for its key product line, and current annual sales are $1 billion, how long will it take for the annual sales to fall below $500 million?

💡Calculate the number of years required based on the depletion rate.

Suggested Answer:

To determine how long it will take for the annual sales of a medical device company to fall below $500 million, given a 6% annual depletion rate on current sales of $1 billion, we can use the formula for exponential decay.

Step 1: Define the Initial Variables

Step 2: Set Up the Decay Formula

Step 3: Solve for t

Step 4: Rearrange the Inequality

Step 5: Take the Logarithm of Both Sides

Step 6: Calculate the Value

Using a calculator to find the logarithms:

Now, substituting the values:

Conclusion

It will take approximately 11 years for the annual sales to fall below $500 million when rounded up to the nearest whole number, considering the 6% annual depletion rate. This calculation helps to illustrate the impact of depletion on revenue over time.

How would you calculate the Weighted Average Cost of Capital (WACC) for a health care company, given the cost of debt, cost of equity, and capital structure?

💡Walk through the steps of calculating WACC using the provided data.

Suggested Answer:

Absolutely, I'm happy to walk you through the steps of calculating the Weighted Average Cost of Capital (WACC) for a healthcare company.

1. Gather the Necessary Data:

Cost of Debt (Kd): This is the effective rate that the company pays on its borrowed funds.

Cost of Equity (Ke): This can be calculated using the Capital Asset Pricing Model (CAPM) or other methods, which accounts for the risk premium over the risk-free rate.

Market Value of Debt (D): The total value of the company’s debt.

Market Value of Equity (E): The total value of the company’s equity.

Total Value of Capital (V): This is the sum of the market value of debt and equity, calculated as V=D+E.

2. Calculate the Proportions of Debt and Equity:

3. Calculate the WACC:

The formula for WACC is:

Note that the cost of debt is adjusted for taxes, as interest expenses are tax-deductible.

4. Example Calculation:

Suppose a healthcare company has:

Cost of Debt (Kd) = 4%

Cost of Equity (Ke) = 10%

Market Value of Debt (D) = $200 million

Market Value of Equity (E) = $800 million

Tax Rate = 25%

First, calculate the total capital:

V= 200+800 = 1000 million.

Then, calculate the weights:

Finally, plug into the WACC formula:

So, the WACC for the healthcare company would be 8.6%. This metric is crucial for evaluating investment opportunities and making informed financial decisions.

A health care company has an operating margin of 30% and revenue of $2 billion. If health care reform reduces reimbursement rates by 10%, how will the operating margin change?

💡Calculate the new operating margin after the reimbursement rate reduction.

Suggested Answer:

To determine how the operating margin changes after a 10% reduction in reimbursement rates, we can follow these steps:

1. Calculate Current Operating Income:

The operating margin is calculated as operating income divided by revenue. Given that the operating margin is 30% and the revenue is $2 billion:

2. Calculate New Revenue After Reimbursement Rate Reduction:

A 10% reduction in reimbursement rates implies that the revenue will decrease by 10%:

3. Calculate New Operating Income:

Assuming operating costs remain constant (which is a simplification, but necessary for this calculation), the new operating income would still be $600 million since it does not depend on revenue in this case. However, the percentage change will affect the operating margin:

4. Conclusion:

After the 10% reduction in reimbursement rates, the new operating margin would be approximately 33.33%.

This indicates that while the operating income remains constant in this scenario, the reduction in revenue has a significant impact on the operating margin, showcasing the importance of reimbursement rates in healthcare profitability.

If the current price of a health care futures contract is $120 per contract, and the risk-free rate is 3%, what should the expected spot price be in one year?

💡Use the cost-of-carry model to estimate the expected spot price.

Suggested Answer:

To estimate the expected spot price of the health care futures contract in one year using the cost-of-carry model, we can follow these steps:

1. Understand the Cost-of-Carry Model:

The cost-of-carry model relates the futures price to the expected spot price by accounting for the risk-free rate of return.

2. Formula for Expected Spot Price:

The formula can be expressed as:

where r is the risk-free rate.

3. Rearranging the Formula:

To find the expected spot price, we can rearrange the formula:

4. Plug in the Values:

Given:

Futures Price = $120

Risk-Free Rate (r) = 3% or 0.03

We can now calculate:

5. Conclusion:

Therefore, the expected spot price of the health care futures contract in one year should be approximately $116.50.

This calculation illustrates how the risk-free rate impacts the expected future value of an asset, which is crucial for making informed investment decisions in equity research.

A health care company invests $500 million in a new clinic and expects to generate $100 million annually for 8 years. What is the project’s Internal Rate of Return (IRR)?

💡Calculate the IRR using the provided cash flows.

Suggested Answer:

To calculate the Internal Rate of Return (IRR) for the health care company's investment in a new clinic, we can follow these steps:

1. Understand the Cash Flows:

Initial investment (Year 0): -$500 million (this is an outflow).

Annual cash inflow for Years 1 to 8: $100 million each year.

2. Set Up the IRR Equation:

The IRR is the rate rrr that makes the Net Present Value (NPV) of the cash flows equal to zero. The equation looks like this:

3. Simplifying the Equation:

This is a series of cash flows, and we can use the formula for the present value of an annuity:

4. Solving for IRR:

Solving this equation typically requires iterative methods or financial calculators/software since it’s a polynomial equation.

5. Using a Financial Calculator or Excel:

If we input the cash flows into a financial calculator or Excel, we can use the IRR function:

Cash Flows: −500,100,100,100,100,100,100,100,

Using Excel’s IRR function:

IRR(Cash Flows) ≈ 11.72

6. Conclusion:

Therefore, the project’s Internal Rate of Return (IRR) is approximately 11.72%.

This IRR indicates the annualized effective compounded return expected from the investment, helping in assessing its profitability compared to the company’s required rate of return.

If a health care company’s CapEx is $700 million this year, and the Depreciation Expense is $150 million, what will be the impact on Free Cash Flow (FCF) if the company increases its CapEx by 15% next year?

💡Adjust CapEx and compute the impact on FCF.

Suggested Answer:

To determine the impact on Free Cash Flow (FCF) if the health care company increases its CapEx by 15% next year, we can follow these steps:

1. Understand the Components:

Current CapEx: $700 million

Current Depreciation Expense: $150 million

2. Calculate the Increased CapEx:

If CapEx increases by 15%, the new CapEx for next year will be:

3. Determine the Impact on FCF:

Free Cash Flow is calculated as:

Since the question doesn’t provide Operating Cash Flow, we can focus on how the increase in CapEx will affect FCF:

The increase in CapEx from $700 million to $805 million results in an additional $105 million in capital expenditures.

4. Conclusion:

Therefore, the increase in CapEx will reduce Free Cash Flow by $105 million next year, assuming Operating Cash Flow remains constant.

This highlights the importance of capital expenditures in assessing a company's cash flow position, as higher CapEx can significantly impact available cash for other operations and investments.

Given that a medical device company’s sales grow by 5% annually, and current sales are $500 million, what will the sales be in five years?

💡Project future sales using the growth rate.

Suggested Answer:

To project the future sales of the medical device company, we can use the formula for future value based on a constant growth rate. Here’s how we can calculate it:

1. Current Sales:

Current sales = $500 million

2. Annual Growth Rate:

Growth rate = 5% or 0.05

3. Number of Years:

Time period = 5 years

4. Future Sales Formula:

The formula to calculate future sales is:

5. Plugging in the Values:

6. Conclusion:

Therefore, the projected sales in five years will be approximately $638.14 million.

This calculation reflects the power of compound growth and highlights the company's potential for revenue expansion over time.

A health care company is considering hedging its exposure to currency fluctuations. If it hedges $100 million in foreign revenue at a forward rate, how will this affect the company’s revenue if the foreign exchange rate shifts unfavorably?

💡Calculate the revenue impact with the hedge in place.

Suggested Answer:

To understand how hedging can affect the company's revenue when there is an unfavorable shift in the foreign exchange rate, let's break down the situation:

1. Current Situation:

The health care company has $100 million in foreign revenue.

They decide to hedge this amount using a forward contract to lock in the exchange rate.

2. Unfavorable Exchange Rate Shift:

Suppose the current spot exchange rate is X (amount of local currency received for $1), and the forward rate they locked in is Y (the rate agreed upon for conversion).

If the foreign exchange rate shifts unfavorably, the new spot rate could be lower, meaning that the company would receive less local currency for its foreign revenue if it did not hedge.

3. Impact of Hedging:

By hedging, the company secures the forward rate (Y), protecting itself from the unfavorable shift.

If, for example, the unfavorable shift means that the new spot rate is Z, where Z<YZ < YZ<Y, the revenue impact without the hedge would have resulted in lower local currency revenue.

4. Calculation Example:

Let’s say:

Forward Rate (Y) = 1.2 local currency per USD.

Unfavorable Spot Rate (Z) = 1.1 local currency per USD.

Revenue Without Hedge:

Revenue With Hedge:

5. Conclusion:

In this example, the hedge protects the company from receiving only $110 million in local currency and instead allows it to secure $120 million.

This illustrates that hedging can effectively safeguard a company’s revenue against unfavorable currency fluctuations, ensuring stability in cash flow from foreign operations.

Given a pharmaceutical company with total debt of $4 billion, EBITDA of $1 billion, and annual interest expense of $200 million, calculate the Debt/EBITDA ratio and the Interest Coverage Ratio.

💡Compute both ratios and interpret their implications.

Suggested Answer:

Let’s calculate the Debt/EBITDA ratio and the Interest Coverage Ratio for the pharmaceutical company.

1. Debt/EBITDA Ratio

Formula:

Given:

Total Debt = $4 billion

EBITDA = $1 billion

Calculation:

2. Interest Coverage Ratio

Formula:

Given:

Interest Expense = $200 million or $0.2 billion

Calculation:

3. Interpretation of Ratios

Debt/EBITDA Ratio of 4.0:

This indicates that the company has $4 of debt for every $1 of EBITDA. A ratio above 3 can suggest potential leverage issues, indicating that the company may be highly leveraged and could face challenges in servicing its debt if earnings fluctuate.

Interest Coverage Ratio of 5.0:

This means that the company can cover its interest expenses 5 times with its EBITDA. Generally, a ratio above 3 is considered healthy, suggesting that the company is in a good position to meet its interest obligations.

You are given two drug development projects with the following cash flows: Project A requires an investment of $1 billion and generates $300 million annually for 5 years; Project B requires an investment of $1.5 billion and generates $400 million annually for 6 years. Which project has a higher NPV, assuming a discount rate of 8%?

💡Calculate and compare the NPVs of both projects.

Suggested Answer:

To determine which drug development project has a higher Net Present Value (NPV), we will calculate the NPV for both Project A and Project B using the provided cash flows and a discount rate of 8%.

1. Net Present Value (NPV) Formula

The NPV formula is as follows:

Where:

Ct = cash inflow during the period ttt

r = discount rate

C0 = initial investment

2. Calculate NPV for Project A

Initial Investment (C0): $1 billion

Annual Cash Flow (C_t): $300 million for 5 years

Discount Rate (r): 8% or 0.08

NPV Calculation for Project A:

Calculating the individual terms:

Sum of Present Values for Project A:

NPV for Project A:

3. Calculate NPV for Project B

Initial Investment (C0): $1.5 billion

Annual Cash Flow (C_t): $400 million for 6 years

NPV Calculation for Project B:

Calculating the individual terms:

Sum of Present Values for Project B:

NPV for Project B:

4. Conclusion

NPV for Project A: $196.98 million

NPV for Project B: $348.69 million

Final Comparison:

Project B has a higher NPV of $348.69 million, compared to Project A's $196.98 million.

This suggests that Project B is the more financially attractive investment option, as it is expected to generate greater value for the company after accounting for the cost of capital.

How would you calculate the break-even price per patient for a health care provider that treats 50,000 patients annually with fixed costs of $100 million and variable costs of $1,000 per patient?

💡Determine the price at which the company breaks even.

Suggested Answer:

To calculate the break-even price per patient, we need to cover both fixed and variable costs.

First, fixed costs are $100 million, and with 50,000 patients, the fixed cost per patient would be:

Adding the variable cost per patient of $1,000, the total cost per patient is:

So, the break-even price per patient is $3,000.

If a pharmaceutical company has Proven Reserves of 200 million units of a drug and Probable Reserves of 50 million units, and the company’s market capitalization is $4 billion, what is the Market Cap per unit of reserves?

💡Calculate the Market Cap per unit of both Proven and Total Reserves.

Suggested Answer:

To calculate the Market Cap per unit of reserves:

Proven Reserves are 200 million units.

Total Reserves (Proven + Probable) are 250 million units (200 million + 50 million).

The company’s Market Cap is $4 billion.

Market Cap per unit of Proven Reserves:

Market Cap per unit of Total Reserves:

So, Market Cap per unit of Proven Reserves is $20 and per unit of Total Reserves is $16.

A biotech company plans to reduce its debt by $100 million over the next five years. If the company’s EBITDA remains constant at $500 million per year, how will this affect the Debt/EBITDA ratio?

💡Project the change in the Debt/EBITDA ratio over time.

Suggested Answer:

If the company plans to reduce its debt by $100 million over five years, that's a $20 million reduction per year. Let’s assume the initial debt is D.

The Debt/EBITDA ratio is calculated as:

Initially, if the debt is D, the ratio is:

After five years, the company’s debt will be reduced by $100 million, so the new debt will be D - 100 million. The new ratio would be:

Therefore, the Debt/EBITDA ratio will decrease gradually each year as the debt reduces, ultimately lowering by 0.2 over the five-year period assuming EBITDA stays constant.

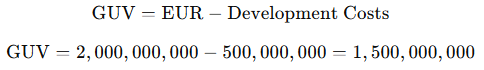

Given a pharmaceutical company with an Expected Ultimate Revenue (EUR) of $2 billion for a new drug, development costs of $500 million, and a current market price of $100 per unit, what is the Gross Undeveloped Value (GUV) of the drug pipeline?

💡Calculate the GUV using the provided data.

Suggested Answer:

To calculate the Gross Undeveloped Value (GUV) of the drug pipeline, we subtract the development costs from the Expected Ultimate Revenue (EUR).

Given:

EUR = $2 billion

Development costs = $500 million

The formula for GUV is:

So, the Gross Undeveloped Value (GUV) of the drug pipeline is $1.5 billion.

If operating costs for a hospital increase by 8% while patient volume remains constant, how will this affect the hospital’s operating margin?

💡Calculate the new operating margin after the cost increase.

Suggested Answer:

If the hospital's operating costs increase by 8% while patient volume and revenue remain constant, the hospital's operating margin will decrease.

When operating costs increase without a corresponding increase in revenue, operating income (Revenue - Operating Costs) decreases, which directly lowers the operating margin.

Since patient volume and revenue stay the same, the 8% increase in costs will reduce profitability, leading to a lower operating margin. The exact reduction depends on the initial margin and cost structure.

You are given the sales decline rates for two drugs: Drug A has a decline rate of 10% per year, and Drug B has a decline rate of 8% per year. Which drug will generate more cumulative revenue over a five-year period?

💡Calculate and compare the cumulative revenue for both drugs.

Suggested Answer:

To compare the cumulative revenue of Drug A and Drug B over a five-year period, we need to consider their annual sales decline rates.

Let’s assume both drugs start with an initial sales of $100 for simplicity.

Drug A has a 10% decline per year.

Year 1: $100

Year 2: $100 × (1 - 0.10) = $90

Year 3: $90 × (1 - 0.10) = $81

Year 4: $81 × (1 - 0.10) = $72.9

Year 5: $72.9 × (1 - 0.10) = $65.61

Cumulative revenue for Drug A over five years:

100 + 90 + 81 + 72.9 + 65.61 =409.51

Drug B has an 8% decline per year.

Year 1: $100

Year 2: $100 × (1 - 0.08) = $92

Year 3: $92 × (1 - 0.08) = $84.64

Year 4: $84.64 × (1 - 0.08) = $77.87

Year 5: $77.87 × (1 - 0.08) = $71.64

Cumulative revenue for Drug B over five years:

100 + 92 + 84.64 + 77.87 + 71.64 =426.15

Conclusion: Drug B will generate more cumulative revenue over five years, with $426.15 compared to Drug A's $409.51.

A health care company is considering two capital investments. Investment X has an IRR of 10% and a payback period of 4 years, while Investment Y has an IRR of 12% and a payback period of 6 years. Which investment should the company choose if the WACC is 9%?

💡Analyze both investments considering the IRR and payback period relative to the WACC.

Suggested Answer:

When comparing these two investments, we need to consider both the Internal Rate of Return (IRR) and the payback period relative to the company's Weighted Average Cost of Capital (WACC) of 9%.

Investment X:

IRR: 10%

Payback period: 4 years

Since the IRR of 10% is greater than the WACC of 9%, Investment X creates value. The shorter payback period of 4 years means the company recovers its investment faster, reducing risk.

Investment Y:

IRR: 12%

Payback period: 6 years

The IRR of 12% is also greater than the WACC, providing a higher return than Investment X. However, it has a longer payback period of 6 years, which means a longer time to recover the investment, increasing the risk.

Conclusion: If the company prioritizes higher returns, Investment Y with the 12% IRR is the better choice, as both IRRs are above the WACC. However, if the company values quicker risk recovery, Investment X with its shorter payback period may be preferred.

If the development cost of a new medical device is $50 million and the expected sales are 2 million units over the product's life, what is the cost per unit?

💡Compute the cost per unit based on development costs and expected sales.

Suggested Answer:

To compute the cost per unit of the new medical device, we can use the formula:

Given:

Development cost = $50 million

Expected sales = 2 million units

Now, plugging in the numbers:

So, the cost per unit is $25.

A health care company’s stock is trading at $100 per share with 30 million shares outstanding. The company has net debt of $1 billion. What is the company’s Enterprise Value (EV)?

💡Calculate the EV using market capitalization and net debt.

Suggested Answer:

To calculate the Enterprise Value (EV) of the health care company, we use the formula:

Calculate Market Capitalization:

Stock price = $100 per share

Shares outstanding = 30 million

Net Debt = $1 billion.

Now, plugging in the values:

So, the company’s Enterprise Value (EV) is $4 billion.

-min.png)

-min.png)

Comments