Leverage Ratio in the Banking Sector

- Analyst Interview

- Dec 30, 2024

- 10 min read

Updated: Jan 4

Understanding the Leverage Ratio in the Banking Sector: A Comprehensive Guide

Introduction

In the world of banking, risk management and financial stability are critical concerns, both for regulators and investors. One key financial metric that helps assess these factors is the Leverage Ratio. This ratio provides valuable insights into how much capital a bank has relative to its total exposure, shedding light on its ability to withstand economic stress and maintain solvency. In this article, we will dive deep into the concept of the leverage ratio, its importance in the banking sector, how it's calculated, and how it plays a pivotal role in assessing the financial health of a bank.

What is the Leverage Ratio?

Definition of the Leverage Ratio

The Leverage Ratio is a financial metric used to assess the proportion of a bank’s Tier 1 capital (the core capital) relative to its total exposure. It provides a measure of how much risk a bank is carrying relative to its financial strength, essentially acting as a buffer against potential losses.

A higher leverage ratio indicates that the bank is using more of its own capital to fund its activities, which makes it less reliant on borrowed funds. Conversely, a lower leverage ratio could signal that the bank is highly leveraged, which might pose a higher risk of insolvency if faced with financial difficulties.

Purpose of the Leverage Ratio in Banking

The primary purpose of the leverage ratio is to assess a bank’s capital adequacy. It serves as a safeguard to ensure that banks have enough capital to absorb shocks and protect depositors and creditors in case of financial stress. It also acts as a constraint on excessive risk-taking, ensuring that a bank is not overly reliant on borrowed funds.

In practice, the leverage ratio is used by regulators to determine if a bank has enough capital in place to withstand unforeseen financial downturns, thereby contributing to the overall stability of the financial system.

The Leverage Ratio Formula

Leverage Ratio Formula for Banks

The leverage ratio is calculated using the following formula:

Where:

Tier 1 Capital: Represents the core capital of the bank, which includes equity capital and disclosed reserves. It is the most stable form of capital, providing the bank with the capacity to absorb losses.

Total Exposure: The total assets of the bank, including on-balance-sheet assets and off-balance-sheet exposures, such as contingent liabilities and derivatives.

Calculating the Leverage Ratio

To calculate the leverage ratio, you would follow these steps:

Obtain Tier 1 Capital: This information is typically available in the bank's financial statements under shareholder equity.

Determine Total Exposure: Add both on-balance-sheet items (e.g., loans, securities) and off-balance-sheet items (e.g., guarantees, derivative contracts).

Apply the Formula: Divide Tier 1 Capital by the Total Exposure to obtain the leverage ratio.

Examples

Let's dive into the leverage ratios of five prominent banks, providing detailed calculations and explanations to illustrate how this metric reflects each bank's financial stability and risk profile.

1. Bank of America (BAC)

As of Q3 2018:

Tier 1 Capital: $186.189 billion

Total Assets: $2.240 trillion

Calculation:

Explanation:

Bank of America's leverage ratio of 8.3% in Q3 2018 was well above the Basel III minimum requirement of 3%, indicating a strong capital buffer relative to its total assets.

Investopedia

2. JPMorgan Chase (JPM)

As of Q3 2020:

Tier 1 Capital: $240.5 billion

Total Assets: $3.4 trillion

Calculation:

Explanation:

JPMorgan Chase's leverage ratio of approximately 7.08% in Q3 2020 reflects a robust capital position, exceeding the regulatory minimum and suggesting a lower risk of insolvency.

3. Citigroup (C)

As of Q4 2019:

Tier 1 Capital: $174.5 billion

Total Assets: $2.3 trillion

Calculation:

Explanation:

Citigroup's leverage ratio of approximately 7.57% in Q4 2019 indicates a solid capital base relative to its total assets, providing a cushion against potential financial shocks.

4. Wells Fargo (WFC)

As of Q2 2021:

Tier 1 Capital: $180.2 billion

Total Assets: $1.9 trillion

Calculation:

Explanation:

Wells Fargo's leverage ratio of approximately 9.48% in Q2 2021 demonstrates a strong capital position, well above the regulatory minimum, indicating a lower risk profile.

5. Goldman Sachs (GS)

As of Q1 2020:

Tier 1 Capital: $68.5 billion

Total Assets: $1.1 trillion

Calculation:

Explanation:

Goldman Sachs' leverage ratio of approximately 6.23% in Q1 2020 indicates a solid capital foundation relative to its total assets, suggesting a moderate risk level.

Regulatory Standards and the Leverage Ratio

Basel III Guidelines on Leverage Ratio

The Basel III framework, established by the Basel Committee on Banking Supervision, introduced minimum leverage ratio standards to ensure that banks maintain sufficient capital to absorb shocks without putting the entire financial system at risk. Basel III recommends a minimum leverage ratio of 3%, meaning that banks must have at least 3% of their total exposure covered by Tier 1 capital.

The leverage ratio is intended as a supplementary measure to the Risk-Based Capital Ratios (like the Capital Adequacy Ratio), providing an additional layer of protection against the risks associated with highly leveraged banking systems.

The Leverage Ratio as a Regulatory Tool

Regulators use the leverage ratio as a tool to:

Limit excessive leverage: By ensuring that banks do not take on too much risk relative to their capital base.

Prevent systemic risk: A high concentration of leverage can lead to systemic risk, where the failure of one bank could trigger widespread financial instability. The leverage ratio acts as a safeguard against such scenarios.

Ensure solvency: Regulators ensure that banks maintain enough capital to cover potential losses, which can help prevent insolvency.

The Importance of the Leverage Ratio in Banking

Assessing Bank Stability and Risk

The leverage ratio is an essential measure of a bank’s financial stability. It reflects how much capital a bank has in relation to the risks it faces. A higher leverage ratio generally indicates a safer, more stable bank, as it implies that the bank can cover more of its total assets with equity capital. This reduces the risk of insolvency during financial distress.

Leverage Ratio and Financial Crises

During financial crises, banks with low leverage ratios are more likely to experience significant challenges. For example, during the 2008 financial crisis, banks with high leverage ratios faced massive losses because they had inadequate capital buffers. The leverage ratio was introduced as a regulatory measure precisely to prevent such situations from recurring.

Interpreting the Leverage Ratio: High vs. Low Ratios

A High Leverage Ratio

A high leverage ratio generally indicates that a bank is more capitalized and has a larger buffer to absorb losses. This is usually seen as a positive sign, signaling that the bank is less reliant on debt and better prepared to weather economic downturns. However, there are trade-offs. A high leverage ratio could mean that the bank is not fully utilizing the potential for growth that debt offers.

A Low Leverage Ratio

On the other hand, a low leverage ratio could be a sign that a bank is highly reliant on debt to finance its activities. This could increase the risk of insolvency, particularly if the bank experiences a downturn or a sudden drop in asset values. Low leverage ratios are often viewed as risky, but they may also indicate that a bank is conservative in its approach to growth and risk management.

Leverage Ratio vs. Other Financial Ratios in Banking

In the banking industry, the Leverage Ratio is just one of several financial metrics used to assess a bank’s financial health, stability, and risk profile. It is often compared with other key ratios, each serving a different purpose in evaluating a bank's performance. Below is a comparison of the Leverage Ratio with other important banking metrics, including their definitions, calculations, and key differences.

1. Leverage Ratio vs. Capital Adequacy Ratio (CAR)

Capital Adequacy Ratio (CAR) is a critical ratio used to assess a bank's capital strength relative to its risk-weighted assets. It helps measure the bank’s ability to withstand financial shocks, particularly those arising from market fluctuations and loan defaults.

Formula for CAR:

Key Difference:

Risk Weighting: Unlike the leverage ratio, which does not account for the riskiness of assets, the CAR adjusts capital for the risk profile of assets. This means that higher-risk assets (e.g., loans to distressed industries) will require more capital to satisfy CAR requirements.

Focus: The leverage ratio is a simpler measure, showing a bank's overall capital against total exposure, while the CAR provides a more nuanced view of capital adequacy considering the riskiness of the bank's assets.

Example: If a bank has $100 billion in risk-weighted assets and $10 billion in Tier 1 capital, its CAR would be:

Leverage Ratio vs. Debt-to-Equity Ratio

The Debt-to-Equity Ratio compares a bank's total debt to its equity capital and is an indicator of how much leverage the bank is using in relation to its shareholder equity.

Formula for Debt-to-Equity Ratio:

Key Difference:

Focus on Debt: The debt-to-equity ratio specifically looks at how much debt the bank has compared to its equity, while the leverage ratio looks at total exposure (including both debt and other risk exposures) relative to Tier 1 capital.

Risk Implications: A higher debt-to-equity ratio could signal higher risk, but it doesn’t directly account for the entire scope of a bank's off-balance-sheet exposures, unlike the leverage ratio.

Example: If a bank has $50 billion in debt and $10 billion in equity, its debt-to-equity ratio would be:

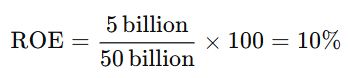

3. Leverage Ratio vs. Return on Equity (ROE)

Return on Equity (ROE) measures a bank’s profitability by comparing its net income to its shareholder equity. It indicates how effectively a bank is using its equity capital to generate profits.

Formula for ROE:

Key Difference:

Focus on Profitability vs. Risk: ROE is primarily a profitability metric, showing how well a bank generates returns relative to its equity. In contrast, the leverage ratio is a measure of financial stability and solvency, showing the ratio of capital to total exposure, not directly related to profitability.

Risk vs. Return: A bank can have a high ROE with relatively low risk, but a low leverage ratio could indicate that it is operating with a solid capital base and is better protected from risks.

Example: If a bank has $5 billion in net income and $50 billion in equity, its ROE would be:

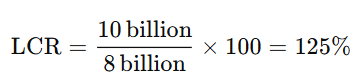

4. Leverage Ratio vs. Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) measures a bank's ability to meet its short-term obligations using its high-quality liquid assets (HQLA). It is a crucial liquidity metric, ensuring banks have enough liquid assets to survive a 30-day financial crisis.

Formula for LCR:

Key Difference:

Liquidity vs. Capital: The leverage ratio focuses on a bank’s capital structure, while the LCR focuses on the bank’s ability to cover its immediate liabilities with liquid assets.

Risk Management: While the leverage ratio ensures long-term capital adequacy, the LCR focuses on short-term liquidity risk and the bank’s ability to handle an immediate financial shock.

Example: If a bank has $10 billion in HQLA and expects $8 billion in net cash outflows over the next 30 days, its LCR would be:

5. Leverage Ratio vs. Tier 1 Capital Ratio

The Tier 1 Capital Ratio is similar to the leverage ratio in that it measures a bank's capital strength, but it compares Tier 1 capital to risk-weighted assets rather than total assets or exposures.

Formula for Tier 1 Capital Ratio:

Key Difference:

Risk Weighting: While the leverage ratio uses total exposure and does not adjust for the riskiness of the bank’s assets, the Tier 1 capital ratio takes into account the risk-weighted assets.

Purpose: The Tier 1 ratio is a risk-adjusted measure of capital adequacy, whereas the leverage ratio is a simpler, non-risk-adjusted measure of capital strength.

Example: If a bank has $30 billion in Tier 1 capital and $400 billion in risk-weighted assets, its Tier 1 Capital Ratio would be:

Challenges in Maintaining an Optimal Leverage Ratio

The Trade-Off Between Leverage and Capital Adequacy

Banks face a balancing act between maintaining sufficient leverage for growth and ensuring they have enough capital to meet regulatory requirements and absorb losses. Maintaining an optimal leverage ratio requires navigating these competing priorities while ensuring profitability and stability.

Economic and Market Factors Affecting the Leverage Ratio

Economic conditions, such as interest rates and market volatility, can affect the leverage ratio. For example, during periods of economic expansion, banks may increase leverage to capitalize on growth opportunities, while during downturns, they may reduce leverage to mitigate risk.

Conclusion

In conclusion, the leverage ratio is a crucial metric for assessing the financial health and stability of banks. It provides regulators, investors, and analysts with insights into a bank's ability to absorb losses, manage risk, and maintain solvency. By understanding the leverage ratio and its implications, stakeholders can make more informed decisions about investing in or regulating banks, contributing to the stability and integrity of the financial system.

FAQs

What is a good leverage ratio for banks?

A leverage ratio of 3% is the minimum required by Basel III regulations, but a higher ratio is typically considered safer.

How does the leverage ratio impact the stability of a bank?

A higher leverage ratio indicates better capital reserves and lower risk, making the bank more stable in the face of financial stress.

Can the leverage ratio be too high for a bank?

Yes, while a higher ratio suggests stability, it could also mean the bank is not utilizing leverage effectively to generate higher returns.

What is the Leverage Ratio in banking?

The Leverage Ratio measures a bank's Tier 1 capital relative to its total exposure (total assets). It shows the bank’s ability to absorb financial losses, with a higher ratio indicating greater financial stability.

How is the Leverage Ratio calculated?

The formula is:

Why is the Leverage Ratio important?

The leverage ratio is crucial for determining how well a bank can withstand financial shocks. It is a simple, straightforward measure of capital adequacy, indicating a bank's financial strength.

What is the ideal Leverage Ratio for a bank?

While the minimum required leverage ratio under Basel III is 3%, many banks aim for higher ratios to ensure stronger capital buffers and lower risk.

How does the Leverage Ratio differ from the Capital Adequacy Ratio (CAR)?

The Leverage Ratio compares Tier 1 capital to total assets, whereas the Capital Adequacy Ratio (CAR) adjusts for the riskiness of the bank's assets. CAR is more complex as it takes into account risk-weighted assets.

Can a high Leverage Ratio be risky?

A high leverage ratio is generally considered positive, indicating a strong capital position. However, if it’s too high, it could indicate that the bank is not using its assets efficiently to generate returns.

How does the Leverage Ratio affect a bank's lending capacity?

A higher leverage ratio means the bank has more capital to absorb losses, but it may also limit the amount it can lend out, as it has a larger capital base relative to its assets.

-min.png)

-min.png)

Commenti