Understanding Return on Capital Employed (ROCE): A Comprehensive Guide

Return on Capital Employed (ROCE) is one of the most important financial ratios used to assess a company's profitability and capital efficiency. It provides valuable insights into how well a company is generating profits from its total capital, which includes both equity and debt. Unlike other profitability ratios that focus purely on equity or earnings, ROCE offers a holistic view of business performance by factoring in all sources of capital.

In this article, we'll explore everything you need to know about ROCE, including its significance, calculation, interpretation, limitations, and how businesses can improve their ROCE over time.

What is Return on Capital Employed (ROCE)?

Return on Capital Employed (ROCE) is a financial metric that measures how efficiently a company uses its capital to generate profits. It is especially important for capital-intensive industries, such as manufacturing or utilities, where large investments in assets are required to generate revenue.

ROCE is calculated as follows:

ROCE = EBIT (Earnings Before Interest and Taxes) / Capital Employed

Where:

EBIT is the operating profit of the company before accounting for interest and taxes.

Capital Employed represents the total capital used by the company, which is the sum of shareholder equity and debt, or alternatively, the difference between total assets and current liabilities.

A higher ROCE value typically indicates that the company is utilizing its capital efficiently, generating more profit per dollar of capital employed.

Importance of ROCE in Financial Analysis

ROCE is a critical tool for investors, analysts, and company management for several reasons:

Profitability Assessment: ROCE provides a clear picture of how well a company is converting its capital investments into profits. It is a key indicator of long-term financial health.

Comparing Companies: ROCE allows for comparisons between companies within the same industry, particularly those with large capital requirements. A higher ROCE suggests better capital efficiency.

Strategic Decision-Making: For management, ROCE helps guide decisions about capital investments. If ROCE is lower than the cost of capital, it may indicate that the company is not generating enough returns to justify its investments.

ROCE vs. Other Profitability Ratios

ROCE often gets compared to other profitability ratios like Return on Equity (ROE) and Return on Assets (ROA). Here's how ROCE stands out:

ROE: While ROE focuses on returns generated solely from shareholders' equity, ROCE includes both equity and debt. This makes ROCE a more comprehensive measure of profitability, especially for companies with significant debt.

ROA: ROA measures the returns generated from total assets. However, it doesn’t account for how those assets were financed. ROCE, on the other hand, incorporates both debt and equity, giving a more accurate picture of financial efficiency.

In summary, ROCE offers a broader analysis than ROE or ROA by considering all capital sources, making it an essential tool in evaluating overall business performance.

How to Calculate ROCE

To calculate ROCE, you’ll need two key figures: EBIT and Capital Employed.

Step 1: Find EBIT (Earnings Before Interest and Taxes)

EBIT can be found on the income statement and represents the operating profit of a business before any interest and taxes are deducted.

Step 2: Determine Capital Employed

Capital employed is the total capital invested in the company. It can be calculated in two ways:

Capital Employed = Total Assets – Current Liabilities

Capital Employed = Shareholders' Equity + Long-term Debt

Both methods yield the same figure, representing the capital that the company uses to generate profits.

Step 3: Apply the ROCE Formula

Using the formula ROCE = EBIT / Capital Employed, divide EBIT by the capital employed figure. The result is expressed as a percentage, representing the return generated from the company's capital.

Interpreting ROCE Results

When interpreting ROCE, it's important to keep the following in mind:

High ROCE: A high ROCE indicates that the company is using its capital efficiently to generate profits. This is a positive sign for investors and stakeholders, suggesting that the company can create significant returns relative to its capital base.

Low ROCE: A low ROCE may indicate inefficiencies in using capital or that the company's investments are not generating sufficient returns. This could be a red flag for potential investors, especially if ROCE is consistently below industry benchmarks.

Industry Context: ROCE benchmarks vary by industry. Capital-intensive industries, like utilities and manufacturing, often have lower ROCE compared to sectors like technology or retail. Therefore, ROCE should be compared to similar companies within the same industry.

Limitations of ROCE

Despite its usefulness, ROCE has some limitations that should be considered:

Historical Nature: ROCE is based on historical financial data, meaning it may not always accurately reflect a company's future performance.

Impact of Depreciation: Companies with older assets may have artificially inflated ROCE due to low book values of depreciated assets. This can make it difficult to compare ROCE across companies with different asset age profiles.

Non-Operating Income Exclusion: Since ROCE uses EBIT, it excludes non-operating income, such as profits from investments or one-time gains. This may give an incomplete picture of a company's total profitability.

Inconsistent Comparisons Across Industries: ROCE is more applicable to capital-intensive industries. In industries where companies rely less on physical assets, such as software or service sectors, ROCE may not be as relevant or insightful.

How to Improve ROCE

Improving ROCE can enhance a company's attractiveness to investors. Here are some strategies businesses can employ:

1. Reduce Operating Expenses

One of the simplest ways to improve ROCE is by reducing operational inefficiencies. Lower operating expenses translate into higher EBIT, thus improving ROCE.

2. Optimize Asset Utilization

Companies can improve their ROCE by maximizing the utilization of their assets. This could involve using existing assets more efficiently, such as increasing production capacity or improving supply chain logistics.

3. Divest Non-Core Assets

Selling off underperforming or non-core assets can increase capital efficiency. By focusing on core operations that generate higher returns, companies can improve their ROCE.

4. Manage Working Capital

Efficient management of working capital, such as reducing inventory levels or improving receivables collection, can reduce the amount of capital employed, thereby increasing ROCE.

5. Strategic Debt Management

Companies that carefully manage their debt levels can improve ROCE. Borrowing too much can dilute returns on capital, while strategic debt management can enhance the profitability generated from each dollar of capital employed.

Real-World Example of ROCE

To analyze the Return on Capital Employed (ROCE) for different companies across various sectors, we can look at five real examples, including their financial statements, calculations, and interpretations.

Understanding ROCE

The ROCE formula is given by:

Where:

EBIT = Earnings Before Interest and Taxes

Capital Employed = Total Assets - Current Liabilities or Total Equity + Long-term Debt

A higher ROCE indicates that a company is using its capital more efficiently to generate profits.

1. Bayer CropScience (Agriculture Sector)

EBIT (FY23): ₹37.3 billion

Total Assets: ₹150 billion

Current Liabilities: ₹30 billion

Capital Employed: ₹150 billion - ₹30 billion = ₹120 billion

ROCE Calculation:

Interpretation: Bayer CropScience has a strong ROCE, indicating effective capital utilization in generating profits, particularly in the growing agricultural sector.

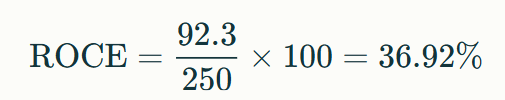

2. Colgate-Palmolive (Personal Care Sector)

EBIT (FY24): ₹92.3 billion

Total Assets: ₹300 billion

Current Liabilities: ₹50 billion

Capital Employed: ₹300 billion - ₹50 billion = ₹250 billion

ROCE Calculation:

Interpretation: Colgate-Palmolive’s ROCE reflects its strong market position and efficiency in the personal care industry, suggesting robust profit generation relative to its capital employed.

3. Nestle India (Food & Beverage Sector)

EBIT (FY24): ₹82.7 billion

Total Assets: ₹350 billion

Current Liabilities: ₹60 billion

Capital Employed: ₹350 billion - ₹60 billion = ₹290 billion

ROCE Calculation:

Interpretation: Nestle India shows a healthy ROCE, indicating effective capital management and strong profitability in the competitive food and beverage market.

4. Tata Consultancy Services (IT Sector)

EBIT (FY24): ₹63.5 billion

Total Assets: ₹500 billion

Current Liabilities: ₹100 billion

Capital Employed: ₹500 billion - ₹100 billion = ₹400 billion

ROCE Calculation:

Interpretation: TCS’s ROCE indicates a solid performance in the IT sector, though it is lower than some peers, suggesting room for improvement in capital efficiency.

5. ICICI Securities (Financial Services Sector)

EBIT (FY24): ₹70.4 billion

Total Assets: ₹200 billion

Current Liabilities: ₹30 billion

Capital Employed: ₹200 billion - ₹30 billion = ₹170 billion

ROCE Calculation:

Interpretation: ICICI Securities boasts a high ROCE, reflecting its strong ability to generate profits from its capital, making it an attractive player in the financial services sector.

Why ROCE Matters for Investors

For investors, ROCE is a key indicator of a company's ability to generate returns from its investments. Here's why it’s important:

Capital Allocation: Investors look for companies that efficiently allocate capital to generate high returns. A high ROCE is a sign that the company is making wise investment decisions.

Risk Assessment: A consistently low ROCE may signal inefficiencies or poor capital management, leading investors to reconsider their stake in the company. It’s also a sign that the company may struggle to cover its cost of capital.

Long-Term Growth Potential: Companies with strong ROCE are often better positioned for sustainable long-term growth, as they have more resources available for reinvestment in the business.

Return on Capital Employed (ROCE) vs Other Financial Ratios: A Comparative Analysis

Return on Capital Employed (ROCE) is a widely used financial ratio that measures a company’s profitability and the efficiency with which it employs its capital. However, to get a complete understanding of a company's financial health, ROCE should be viewed alongside other financial ratios.

Key ratios like Return on Equity (ROE), Return on Assets (ROA), and Return on Investment (ROI) serve different purposes in financial analysis and complement ROCE in providing a well-rounded picture of a company’s performance.

Return on Capital Employed (ROCE) Explained

Before diving into the comparison, it's important to briefly recap what ROCE measures.

ROCE is a profitability ratio that calculates the percentage return a company generates from the capital it employs, which includes both equity and debt. It shows how efficiently a company uses its available capital to generate profits.

The formula for ROCE is:

ROCE = EBIT (Earnings Before Interest and Taxes) / Capital Employed

Capital Employed is the sum of shareholders' equity and long-term debt, or alternatively, total assets minus current liabilities.

A high ROCE indicates that the company is using its capital efficiently to generate value, making it a key metric for investors and management in capital-intensive industries.

ROCE vs. Return on Equity (ROE)

Return on Equity (ROE) is one of the most commonly used ratios in financial analysis, particularly from the perspective of shareholders. ROE measures the profitability of a company relative to shareholders’ equity.

Formula for ROE:

ROE = Net Income / Shareholders' Equity

Key Differences Between ROCE and ROE:

Capital Consideration:ROE looks only at equity and disregards debt, while ROCE considers both debt and equity. This means that ROCE provides a more comprehensive view of how efficiently a company uses all its capital, not just equity.

Profitability Focus:ROE directly ties profitability to shareholders' equity, making it more relevant for investors focused on returns on their personal investments. In contrast, ROCE gives a broader picture of the company's overall profitability from its entire capital base, making it useful for all stakeholders, including lenders.

Debt Influence:Companies with high levels of debt may have a high ROE due to lower equity, but this does not necessarily indicate efficient use of capital. ROCE corrects this by factoring in debt, making it a more reliable indicator of true capital efficiency.

When to Use ROE:

ROE is ideal for evaluating how much return shareholders are getting for their investment.

Best for companies that are not highly leveraged or for investors primarily concerned with equity returns.

When to Use ROCE:

ROCE is more useful when comparing companies with different capital structures, especially when a company uses a significant amount of debt.

ROCE vs. Return on Assets (ROA)

Return on Assets (ROA) measures the efficiency of a company in generating profit from its total assets. It shows how well a company is utilizing its asset base to create income.

Formula for ROA:

ROA = Net Income / Total Assets

Key Differences Between ROCE and ROA:

Capital Employed vs. Total Assets:While ROCE looks at both equity and debt (capital employed), ROA focuses exclusively on total assets, without distinguishing how these assets were financed (whether through debt or equity). This makes ROCE a better indicator of capital efficiency for companies with varying levels of debt.

Profit Measure:ROCE uses EBIT (operating income), while ROA relies on net income. EBIT excludes interest and taxes, meaning ROCE provides a clearer picture of operational profitability without the influence of financing costs, making it ideal for comparing companies with different debt levels.

Focus on Asset Utilization:ROA is focused on how efficiently a company uses its assets to generate profit. This makes ROA more relevant for asset-heavy companies, where managing asset productivity is key. ROCE, on the other hand, gives more insight into how efficiently the company uses its entire capital base, not just assets.

When to Use ROA:

ROA is best for evaluating the efficiency of asset utilization, particularly in industries where managing large asset bases (e.g., real estate, manufacturing) is critical.

It is also useful for assessing companies with low levels of debt, where the distinction between total assets and capital employed is less significant.

When to Use ROCE:

ROCE is more useful for assessing overall capital efficiency, particularly for companies with significant debt.

It’s ideal for capital-intensive industries, where both assets and capital structure (equity and debt) play an important role.

ROCE vs. Return on Investment (ROI)

Return on Investment (ROI) is a general-purpose profitability ratio that measures the efficiency of an investment in generating returns. It is commonly used in evaluating specific projects, investments, or overall business ventures.

Formula for ROI:

ROI = (Net Profit / Investment Cost) x 100

Key Differences Between ROCE and ROI:

Scope of Application:ROI is more versatile and can be used to assess the profitability of specific projects, initiatives, or investments. ROCE, in contrast, applies to the overall company performance and its ability to use capital to generate returns.

Calculation Basis:ROI looks at the profitability of a specific investment relative to its cost, while ROCE looks at profitability relative to the company's overall capital base. ROI can be applied in various contexts, such as marketing campaigns, new product launches, or personal investments, whereas ROCE focuses strictly on corporate financial performance.

Investment vs. Operational Focus:ROI is often used for short-term or one-off investments, whereas ROCE focuses on long-term operational performance. ROCE evaluates the effectiveness of ongoing operations in generating returns from the total capital employed.

When to Use ROI:

ROI is best for evaluating the profitability of a specific investment or project, rather than a company’s overall financial health.

It's frequently used by investors to compare the returns of different potential investments.

When to Use ROCE:

ROCE is ideal for assessing a company’s long-term ability to generate profits from its capital base, rather than the return on a specific project or short-term investment.

ROCE vs. Net Profit Margin

Net Profit Margin measures how much of a company’s revenue remains as profit after all expenses, including taxes and interest, have been deducted.

Formula for Net Profit Margin:

Net Profit Margin = (Net Profit / Revenue) x 100

Key Differences Between ROCE and Net Profit Margin:

Focus on Revenue vs. Capital:Net profit margin focuses on the relationship between profit and revenue, showing how much profit a company generates from each dollar of sales. ROCE, on the other hand, looks at the profitability relative to the capital employed, making it more relevant for understanding how well a company is using its resources to generate returns.

Application:Net profit margin is more relevant in industries where revenue generation is the primary focus, such as retail or services. ROCE is more appropriate for capital-intensive industries, where the efficiency of capital use is crucial.

When to Use Net Profit Margin:

Use net profit margin when assessing how efficiently a company converts revenue into profit.

It's ideal for businesses where revenue generation is the key focus, and operational costs need to be tightly managed.

When to Use ROCE:

ROCE is more relevant when you want to assess how well a company uses its capital, especially when capital allocation and investment decisions play a critical role in the business model.

Conclusion

Return on Capital Employed (ROCE) is an essential financial metric that offers a clear view of how efficiently a company is using its capital to generate profits. While it has its limitations, ROCE is invaluable for comparing companies within capital-intensive industries and making strategic financial decisions. For investors, ROCE provides insights into a company's financial health, risk profile, and potential for long-term growth.

By understanding ROCE and how it can be improved, companies can drive better capital efficiency, leading to stronger profitability and greater value for shareholders.

FAQs

What is a good ROCE percentage?

A good ROCE percentage depends on the industry, but generally, a ROCE above 10-15% is considered strong. However, it's important to compare ROCE to industry benchmarks.

How can ROCE be improved?

ROCE can be improved by reducing operating expenses, optimizing asset utilization, managing working capital efficiently, and divesting non-core assets.

Is ROCE the same as ROE?

No, ROCE measures profitability relative to total capital (both equity and debt), while ROE focuses only on returns from shareholders' equity.

Can ROCE be negative?

Yes, ROCE can be negative if a company’s EBIT is negative or if the capital employed is greater than the returns generated.

Why is ROCE important for investors?

ROCE helps investors understand how well a company is generating profits from its total capital. It's a key metric for assessing capital efficiency and long-term financial health.

How is capital employed calculated?

Capital employed is calculated by subtracting current liabilities from total assets, or by summing shareholders' equity and long-term debt.

-min.png)

-min.png)

Comentários