The Power of Return on Invested Capital: A Comprehensive Guide

Return on Invested Capital (ROIC) is one of the most important financial metrics investors and business leaders use to assess a company's ability to generate returns from its investments. Unlike simple profitability metrics like net income, ROIC provides a deeper view into how well a business is using its capital to create value. But understanding ROIC requires a thorough grasp of how it is calculated, its importance in strategic decision-making, and its real-world applications in various industries.

What is Return on Invested Capital (ROIC)?

Return on Invested Capital (ROIC) is a profitability ratio that measures how efficiently a company uses its invested capital to generate returns. In essence, it evaluates the effectiveness of a company's investment decisions and its ability to create value for shareholders. This metric is particularly insightful because it helps differentiate between companies that are merely profitable and those that truly maximize shareholder value.

Invested capital typically includes equity and debt that a company uses to fund its operations and grow. The key here is that ROIC shows whether a company is generating returns greater than its cost of capital. In other words, it helps investors understand if the company's growth is sustainable and value-accretive.

ROIC Formula and Calculation

The formula for calculating ROIC is relatively straightforward, but it's important to break it down:

ROIC = Net Operating Profit After Taxes (NOPAT) / Invested Capital

Here’s what each term means:

Net Operating Profit After Taxes (NOPAT): This is a company's profit from operations after adjusting for taxes. It excludes interest expenses, focusing purely on operational performance.

Invested Capital: The total capital a company has invested in its operations. This typically includes both debt and equity, minus cash and non-operating assets.

Let’s consider an example. Suppose a company has a NOPAT of $200 million and invested capital of $1 billion. The ROIC would be:

ROIC = $200 million / $1 billion = 20%

This means the company is generating a 20% return on every dollar of capital invested.

To analyze the Return on Invested Capital (ROIC) for five real companies across different sectors, we will calculate the ROIC using the formula:

Where:

NOPAT (Net Operating Profit After Tax) is calculated as:

Invested Capital is calculated as:

1. Apple Inc. (AAPL) - Technology Sector

Operating Income: $108.5 billion

Tax Rate: 15%

Total Equity: $65 billion

Total Debt: $120 billion

Cash and Cash Equivalents: $25 billion

Calculations:

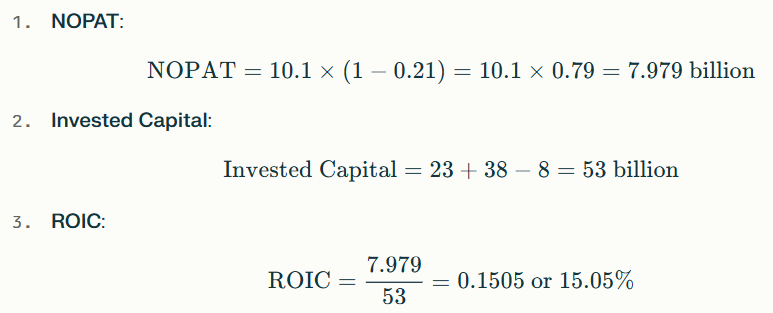

2. Coca-Cola Co. (KO) - Beverage Sector

Operating Income: $10.1 billion

Tax Rate: 21%

Total Equity: $23 billion

Total Debt: $38 billion

Cash and Cash Equivalents: $8 billion

Calculations:

3. ExxonMobil (XOM) - Energy Sector

Operating Income: $55 billion

Tax Rate: 25%

Total Equity: $180 billion

Total Debt: $40 billion

Cash and Cash Equivalents: $5 billion

Calculations:

4. Procter & Gamble Co. (PG) - Consumer Goods Sector

Operating Income: $15 billion

Tax Rate: 21%

Total Equity: $75 billion

Total Debt: $30 billion

Cash and Cash Equivalents: $10 billion

Calculations:

5. JPMorgan Chase & Co. (JPM) - Financial Sector

Operating Income: $45 billion

Tax Rate: 21%

Total Equity: $270 billion

Total Debt: $200 billion

Cash and Cash Equivalents: $50 billion

Calculations:

Why is ROIC Important?

ROIC is a key indicator of a company's financial health and management’s efficiency in deploying capital. It offers several critical insights:

1. Measuring Capital Efficiency

One of the primary reasons ROIC is so valuable is that it measures how well a company is utilizing its capital. If a company consistently generates high ROIC, it suggests that management is efficiently allocating resources to profitable projects. Conversely, a low ROIC may indicate that the company is struggling to make effective use of its capital, potentially wasting shareholder money.

2. ROIC and Competitive Advantage

A company's ability to consistently generate high ROIC often indicates the presence of a sustainable competitive advantage. This could be due to a strong brand, patented technology, or operational efficiencies that competitors cannot easily replicate. Investors often look for companies with a high ROIC as these firms are likely to continue delivering value over the long term.

3. ROIC vs. Cost of Capital (WACC)

For a company to create value, its ROIC must exceed its weighted average cost of capital (WACC). The WACC represents the average rate a company must pay to finance its operations, factoring in both debt and equity costs. If a company’s ROIC is lower than its WACC, it is destroying value, while a higher ROIC indicates value creation.

For example, if a company has a WACC of 8% and an ROIC of 12%, it is effectively generating 4% more than it costs to finance its capital. This difference is crucial for long-term growth and shareholder wealth.

4. Assessing Business Performance Across Industries

ROIC is particularly useful when comparing companies in different industries. Some industries, such as software and pharmaceuticals, tend to have higher ROICs due to low capital requirements and high margins. In contrast, capital-intensive industries like manufacturing and utilities might have lower ROICs because they require significant investment in assets like plants and equipment. Understanding these nuances helps investors compare companies more accurately within their respective sectors.

ROIC vs. Other Profitability Metrics

While ROIC is a powerful tool, it is not the only metric used to assess profitability. Let’s explore how it compares to other commonly used metrics like Return on Equity (ROE) and Return on Assets (ROA).

ROIC vs. ROE

Return on Equity (ROE) measures the return on shareholders' equity, which is essentially the profit generated for each dollar of equity invested by shareholders. ROE is a narrower metric than ROIC because it only considers equity, whereas ROIC includes both equity and debt.

ROIC is generally considered a more comprehensive metric than ROE because it accounts for the full scope of a company’s capital structure. For instance, a company with high debt may have a high ROE, but its ROIC might be low if its debt financing is expensive. This distinction makes ROIC a better measure of overall capital efficiency.

ROIC vs. ROA

Return on Assets (ROA) measures the return generated on a company’s total assets. Like ROIC, ROA is useful for understanding how efficiently a company is using its assets to generate profits. However, ROIC focuses specifically on the capital invested by shareholders and lenders, making it a more targeted metric for evaluating capital efficiency.

For capital-intensive businesses, ROA may be less informative than ROIC because it doesn’t account for the cost of the capital used to finance those assets.

Improving ROIC: Strategies for Businesses

Improving ROIC is a common goal for business leaders, as it directly impacts shareholder value. There are several strategies companies can use to boost their ROIC:

1. Cost Control

Reducing operating costs can significantly improve a company’s NOPAT, which in turn boosts ROIC. This can be achieved through better supply chain management, process improvements, or cutting non-essential expenses.

2. Streamlining Capital Expenditures

Focusing on high-return projects and avoiding unnecessary capital expenditures can enhance invested capital efficiency. Businesses should carefully evaluate the potential return on investment (ROI) of each new project to ensure they are not tying up capital in low-yield assets.

3. Reducing Debt Levels

Excessive debt can weigh down a company's financial performance, especially if interest expenses are high. By reducing debt, companies can free up more capital to reinvest in profitable projects, thus improving their ROIC.

4. Increasing Sales Without Adding Capital

Finding ways to grow revenue without significantly increasing capital investment can also improve ROIC. This could involve strategies like expanding into new markets, introducing new product lines, or leveraging digital technologies to reach more customers.

Common Pitfalls When Using ROIC

While ROIC is a valuable metric, there are potential pitfalls that investors should be aware of when interpreting it.

1. Misinterpreting Short-Term Fluctuations

ROIC can fluctuate from year to year due to one-time events like acquisitions, divestitures, or restructuring charges. It’s important to look at a company’s ROIC trend over several years rather than focusing on short-term changes that may not reflect the company’s underlying performance.

2. Ignoring Industry Differences

As mentioned earlier, ROIC can vary significantly across industries. Comparing the ROIC of a technology company with that of a utility company may lead to misleading conclusions. Investors should compare companies within the same industry to get an accurate sense of performance.

3. Focusing Solely on ROIC

ROIC is a powerful metric, but it should not be used in isolation. Investors should also consider other factors like revenue growth, profit margins, and cash flow when evaluating a company's overall financial health.

ROIC vs Other Financial Ratios: A Detailed Comparison

Return on Invested Capital (ROIC) is a key financial ratio used to evaluate a company's efficiency in using its invested capital to generate profits. However, while ROIC is powerful, it's not the only financial ratio that investors use to measure a company's performance. Other ratios, like Return on Equity (ROE), Return on Assets (ROA), and various profitability and efficiency metrics, offer different perspectives. Understanding how ROIC stacks up against these metrics helps investors make more informed decisions.

In this article, we will delve into how ROIC compares with other commonly used financial ratios, highlighting the unique insights each provides and when one might be more appropriate than the others.

ROIC: An Overview

ROIC measures how well a company utilizes its capital equity and debt combined to generate returns. The formula is:

ROIC = Net Operating Profit After Taxes (NOPAT) / Invested Capital

This ratio helps assess whether a company is creating value for its shareholders by generating returns greater than the cost of capital. It takes into account both operating performance and the capital structure, making it a comprehensive measure of efficiency.

Let’s explore how ROIC compares with other common financial ratios.

ROIC vs. Return on Equity (ROE)

What is ROE?

Return on Equity (ROE) is a profitability metric that measures how effectively a company generates profits using shareholders' equity. The formula is:

ROE = Net Income / Shareholders' Equity

ROE focuses specifically on the return generated for the company’s owners—its shareholders—without considering how much debt the company is carrying. It’s often used by equity investors to evaluate how well their capital is being used.

Key Differences Between ROIC and ROE

Capital Structure Consideration: ROIC includes both equity and debt, giving a holistic view of capital efficiency. ROE, on the other hand, only looks at equity, ignoring the role of debt. A company with high debt may have a high ROE due to the leverage effect, but its ROIC might be lower if the cost of that debt is significant.

Leverage Impact: A high ROE can sometimes be misleading if it is driven by excessive leverage. ROIC, being independent of capital structure, provides a more accurate picture of overall efficiency.

Comprehensive View: ROIC offers a broader assessment of a company’s performance by considering all invested capital, not just equity. This makes ROIC a more reliable indicator of long-term value creation.

When to Use ROE vs. ROIC?

ROE is best used when you are primarily concerned with equity returns, especially for companies with low debt. ROIC is a better measure when evaluating the overall efficiency of capital use, including debt.

ROIC vs. Return on Assets (ROA)

What is ROA?

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit. The formula is:

ROA = Net Income / Total Assets

ROA focuses on the company’s ability to convert its asset base into profits. It’s useful for understanding how well a company’s resources are being utilized, without considering the capital structure (debt vs. equity).

Key Differences Between ROIC and ROA

Capital vs. Assets: While ROA focuses solely on total assets, ROIC specifically looks at the capital used to finance the business. This makes ROIC more focused on the financing aspect of efficiency, while ROA is better for understanding how well the company's resources (both operational and financial) are deployed.

Debt Consideration: ROIC takes into account both debt and equity financing, offering a more nuanced view of performance in cases where debt plays a significant role. ROA is simpler but can be less informative for capital-intensive companies with significant debt loads.

NOPAT vs. Net Income: ROIC uses NOPAT, which excludes interest, focusing on operational efficiency. ROA uses net income, which includes interest and can be affected by financial leverage.

When to Use ROA vs. ROIC?

ROA is most useful for industries that rely heavily on assets to generate income, such as manufacturing and utilities. ROIC, with its focus on capital, is more appropriate when assessing the return on all the capital invested in a business, especially for companies with significant debt.

ROIC vs. EBITDA Margin

What is EBITDA Margin?

EBITDA margin measures a company’s operating profitability as a percentage of its total revenue. The formula is:

EBITDA Margin = EBITDA / Revenue

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) gives a sense of a company's operating profitability, ignoring non-cash charges and the effects of debt.

Key Differences Between ROIC and EBITDA Margin

Profitability vs. Efficiency: EBITDA margin is purely a measure of operating profitability, showing how much of each dollar of revenue is left after operating expenses. ROIC, however, measures efficiency in generating returns on the invested capital, focusing on long-term value creation rather than short-term profitability.

Debt Consideration: EBITDA margin ignores interest, meaning it doesn’t account for the company’s debt structure. ROIC, on the other hand, reflects the efficiency of capital use, including the impact of both debt and equity.

Usefulness in Capital Allocation: ROIC provides more insight into capital allocation decisions, showing how well a company is using its investments to create value, while EBITDA margin is more focused on profitability from core operations.

When to Use EBITDA Margin vs. ROIC?

EBITDA margin is useful when comparing profitability across companies with different capital structures or levels of debt. ROIC is better suited for evaluating overall capital efficiency and long-term value creation.

ROIC vs. Debt-to-Equity Ratio

What is Debt-to-Equity Ratio?

The debt-to-equity ratio is a leverage ratio that compares a company’s total debt to shareholders' equity. The formula is:

Debt-to-Equity Ratio = Total Debt / Shareholders' Equity

This ratio shows how much of a company’s capital comes from debt compared to equity, helping investors assess financial risk.

Key Differences Between ROIC and Debt-to-Equity Ratio

Efficiency vs. Risk: ROIC measures efficiency in generating returns on capital, while the debt-to-equity ratio measures financial risk and leverage. A high debt-to-equity ratio may indicate higher financial risk, but ROIC focuses on whether that leverage is being used effectively.

Capital Use: ROIC shows how well both debt and equity are being used to generate returns. The debt-to-equity ratio, however, focuses only on the relative proportion of debt to equity, without providing insights into how well those funds are used.

Value Creation: ROIC tells investors whether a company is generating value above its cost of capital, while the debt-to-equity ratio is a risk metric that doesn’t provide insights into profitability or efficiency.

When to Use Debt-to-Equity Ratio vs. ROIC?

Use the debt-to-equity ratio when assessing a company’s financial risk and leverage. ROIC is more appropriate when analyzing capital efficiency and value creation, particularly in relation to debt.

FAQs

How does ROIC differ from ROI?

ROIC focuses on long-term, company-wide capital efficiency, while ROI typically measures the return on a specific project or investment.

What is a good ROIC?

A good ROIC is one that exceeds a company’s cost of capital (WACC). Typically, an ROIC above 10% is considered strong.

Can ROIC be negative?

Yes, a negative ROIC indicates that a company is not generating sufficient returns to cover its capital costs, often a sign of poor financial health.

How is ROIC useful for investors?

ROIC helps investors assess how efficiently a company is using its capital and whether it is generating returns above its cost of capital, which is critical for long-term value creation.

Does ROIC apply to all industries?

Yes, but it’s important to compare companies within the same industry, as capital requirements vary significantly across sectors.

Why is ROIC important in mergers and acquisitions?

In mergers and acquisitions, ROIC helps assess whether the acquired assets will generate returns that exceed the cost of the acquisition, making it a key metric for evaluating deal success.

Conclusion

Return on Invested Capital (ROIC) is a critical metric that provides deep insights into a company’s financial performance, capital efficiency, and value creation capabilities. It plays a pivotal role in helping investors and business leaders make informed decisions about capital allocation, strategy, and long-term growth. By focusing on ROIC, businesses can ensure they are not only profitable but also generating sustainable value for their shareholders.

-min.png)

-min.png)

Comments